Airpoints™ Debit Mastercard®.

Earn Airpoints Dollar™ on your everyday spend¹ with New Zealand's only Airpoints earning debit card.

Get $50 on us.

Open a Westpac Everyday account by 9 March 2026 and you could earn $50.

Just add a Westpac Debit Mastercard® or Airpoints™ Debit Mastercard® to your mobile wallet, then make a purchase using Apple Pay or Google Pay™ by 6 April 2026.

T&Cs apply. Must be 18+ and not have an existing Westpac Everyday account.

Benefits.

- Earn 1 Airpoints Dollar™ for every $300 spent on your card¹.

- No annual fee for the first year.

- Annual fee waived completely for under 19 year olds.

- No international transaction fees when you use your card at our Global ATM Alliance ATMs.

- Make contactless payments without a PIN for transactions up to $200.

Features.

Use Airpoints Dollars for rewards

Reward yourself with flights and other travel benefits, or choose from thousands of items online at the Airpoints Store.

Pay with your mobile

Make fast, easy and secure contactless payments with Apple Pay3 or Google Payᵀᴹ4.

24/7 fraud protection

CardGuard® protects your cards and mobile payments, which means you can enjoy round-the-clock protection from fraudulent activity and unauthorised transactions at no extra cost5.

Use it anywhere

Use it online, over the phone and at over 35 million locations around the world where Mastercard® is accepted.

Bank on the go

With Westpac One® digital banking you can manage your money, temporarily block a card or even open a savings account using your smartphone, tablet or computer.

Smart money tools

We've got a range of free tools to help you track and categorise your spending, set up alerts, manage your income and more.

Access your money straight away

If you've applied online, access your money straight away without a physical card using Apple Pay or Google Pay™. Handy!

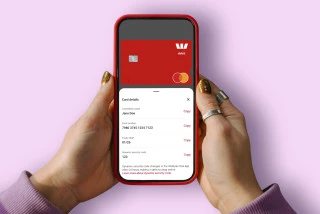

A safer way to pay with your digital card.

It’s a digital version of your debit or credit card*, stored safely in the Westpac One® app. It comes with a dynamic security code that refreshes after 24 hours to reduce the risk of fraud if your card details are ever stolen.

*Dynamic security code is available for all eligible Westpac debit and credit Mastercard customers. Excludes Business Mastercard, Business Prepaid Mastercard and Global Currency Cards.

Fees.

The Airpoints debit card has an annual fee of $15 (free for the first year). If you're under 19, there is no annual fee. You could pair this up with a Westpac Everyday transaction account which has fee free electronic banking. If you’re at school or studying and have a Career Starter, Tertiary or Graduate Account, we'll waive the annual fee while you qualify for that Account.

What you need to get an Airpoints Debit Mastercard.

- An eligible Westpac transaction account (eligible accounts include a Westpac Everyday, Westpac Easy Access and/or Choices Everyday Home Loan Account).

- To be an Airpoints Member.

Apply for a debit card.

New to Westpac?

You can apply online in minutes for a transaction account and debit card. All you need is your New Zealand Passport or Driver Licence for verification.

Already a Westpac customer?

Apply via Westpac One® online banking. If you’re not yet registered for Westpac One, call us on 0800 400 600 and press 7.

Quick help.

Things you should know.

1 Certain purchases and transactions do not earn Airpoints Dollars (See the Debit Card Conditions of Use for full details), including; fees, charges or interest, tax payments (including local council rates and ACC Levies), gambling chips or gambling transactions (including online gambling), cash withdrawals from your account, money orders, travellers cheques and foreign currencies in cash, and business-related purchases.

2 Saving applies to Westpac customers who use an ATM belonging to a member of the Global ATM Alliance only, and is subject to change. Global ATM Allliance member banks are subject to change. All other international and standard fees apply, including foreign currency conversion fees - refer to the Transaction and Service fees brochure for details.

3 Apple Pay is available to eligible Westpac debit and credit Mastercard customers. Customers also need a compatible Apple device. For a list of compatible Apple Pay devices, see Apple Support. Terms and conditions apply to Apple Pay see Westpac Apple Pay Terms and Conditions for more information.

4 Google Pay is available to eligible Westpac debit and credit Mastercard customers. Customers also need a compatible Android device. For a list of compatible Google Pay devices, see Google Support. Terms and conditions apply to Google Pay see Westpac Google Pay Terms and Conditions for more information.

5 Provided you notify us as soon as possible, have not acted fraudulently or negligently, and have complied with the Card Conditions of Use

6 The annual fee is waived for: customers 19 years and over (fee waived for the first year), customers under 19 years.

7 A foreign currency fee is charged when you make a purchase or cash withdrawal in a foreign currency, and also applies to any fees and charges charged by the overseas bank or vendor in relation to the transaction. This fee is also charged when you make online purchases in a foreign currency.

8 These fees do not apply if you use your Westpac card in an ATM belonging to a member of the Global ATM Alliance. The fee saving is subject to change. Global ATM Alliance member banks are subject to change. All other international and standard fees apply, including foreign currency conversion fees – refer to Transaction and Service fees brochure for details.

You must be a member of Air New Zealand’s Airpoints programme to be eligible to earn Airpoints Dollars. Airpoints terms and conditions apply – see airnewzealand.co.nz/airpoints-terms-and-conditions for details.

Airpoints™ and Airpoints Dollars™ are registered trademarks of Air New Zealand Limited

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Eligibility criteria, terms and conditions apply. See:

Westpac One App Terms and Conditions which incorporate Westpac’s General Terms and Conditions and the Westpac Website Terms of Use apply.