Credit cards.

A credit card gives you access to credit up to an agreed limit, so you can pay for goods or services anywhere Mastercard® is accepted.

Credit card options.

Compare cards

Unlock unforgettable experiences with presale tickets.

Access Mastercard Presale and Preferred tickets and priceless experiences with your Westpac Mastercard.

Credit cards don't have to be scary.

When it comes to credit cards and debt, it can seem like hidden dangers are lurking everywhere. In our Fear-Free Credit Guide, you’ll get practical advice to help you dodge those dangers and build healthy credit habits.

What is a credit card?

A credit card gives you access to credit up to an agreed limit, so you can pay for goods or services anywhere Mastercard® is accepted.

With a credit card, you should aim to pay the balance owing in full each month to avoid paying interest on your purchases. There are other fees and charges that apply which are outlined on our website.

If you’re looking to use a credit card for a large one-off payment, it might not be the right product for you. You can talk through your options with someone in our team either at your local branch or by giving us a call on 0800 400 600.

If you think a credit card is right for you, the next step is to decide which type of card to get. To help you decide which credit card is best for you, compare our cards.

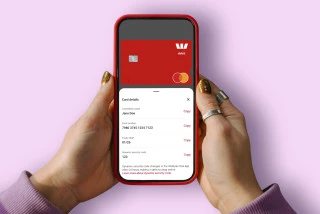

A safer way to pay with your digital card.

It’s a digital version of your debit or credit card*, stored safely in the Westpac One® app. It comes with a dynamic security code that refreshes after 24 hours to reduce the risk of fraud if your card details are ever stolen.

*Dynamic security code is available for all eligible Westpac debit and credit Mastercard customers. Excludes Business Mastercard, Business Prepaid Mastercard and Global Currency Cards.

Why Westpac?

24/7 protection

With CardGuard you’re protected 24/7 from fraudulent activity1. Use your card anywhere, anytime, and leave your worries behind.

Smart ways to pay

Enjoy all the benefits of a Westpac credit card using your mobile device with Apple Pay2 or Google Pay™3.

Track your spending

CashNav lets you track and categorise your spend so you can see where your money is going and better understand your spending habits.

Things you should know.

* Third party fees and Westpac charges may apply. For full details refer to the Westpac Fee Free Mastercard® Conditions of Use and the our Transaction and Service Fees brochure.

**Rate will apply to balance(s) transferred until that balance(s) is paid off. Balance Transfer Terms and Conditions and lending criteria apply. All applications are subject to Westpac approval. You cannot transfer a balance from a Westpac card or loan. You can transfer up to 95% of your available credit card limit. Your card must remain within its credit limit after the balance has been transferred. Balances cannot be transferred to a Mastercard® BusinessCard/Purchasing Card. Balance transfers do not earn Airpoints Dollars™ or hotpoints®. Payments you make to your Westpac credit card will first go to charges and interest accrued, then to cash advances and purchases, followed by balance transfers as they appear on your last statement. Payments will then be applied to transactions that have not yet appeared on a statement in the same order. If you have multiple balance transfer rates, payments will first be applied to the balance transferred on the highest interest rate. Interest rates are subject to change without notice. All new purchases, cash advances and any unpaid interest or fees will incur interest at the standard interest rate in accordance with the card’s Conditions of Use.

1 Provided you notify us as soon as possible, have not acted fraudulently or negligently, and have complied with the card's Conditions of Use.

2Apple Pay is available to eligible Westpac debit and credit Mastercard customers. Customers also need a compatible Apple device. For a list of compatible Apple Pay devices, see Apple Support. Terms and conditions apply to Apple Pay, see Westpac Apple Pay Terms and Conditions for more information.

3Google Pay is available to eligible Westpac debit and credit Mastercard customers. Customers also need a compatible Android device. For a list of compatible Google Pay devices, see Google Support. Terms and conditions apply to Google Pay, see Westpac Google Pay Terms and Conditions for more information.

You must be a member of Air New Zealand's Airpoints™ programme to earn Airpoints Dollars. Airpoints Terms and Conditions.

Airpoints™ and Airpoints Dollars™ are registered trademarks of Air New Zealand Limited.

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

Mastercard® is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.

Lending criteria, Terms and Conditions apply. Conditions of Use for the applicable card apply. If you only make the minimum repayment each month, you will pay more interest and it will take you longer to pay off the unpaid balance.

Rates, Transaction and Services Fees apply. Interest rates and fees subject to change.

Westpac One App Terms and Conditions which incorporate Westpac’s General Terms and Conditions and the Westpac Website Terms of Use apply.