Home loan repayment options.

Take a look at the different loan types that are available and choose a home loan with the repayment option that suits you.

Key elements of a loan.

Interest rates

When you take out a home loan, the interest rate determines how much you are charged for borrowing the principal loan amount. You can choose a fixed rate which stays the same or a floating rate which can go up or down with the market.

Principal and interest

To pay off a loan, you have to pay back the principal - that's the amount you have borrowed - plus pay the interest you are charged for borrowing it.

Repayment structure

When signing up to a Westpac home loan, you have a choice in how you repay the principal and the interest. Different loan types enable you to repay in different ways.

Loan types.

Table loan

With a table loan, your regular payments stay the same, unless your interest rate changes. Initially, payments mostly pay off the interest you owe, but over time, as you start to pay down your loan, more of each payment goes towards paying off the principal. This is the most popular type of home loan because your regular repayments are the same, which can help you to budget.

Choices Fixed and Choices Floating (including Choices Floating with Offset) home loans can be paid off as a table loan.

Reducing (flat) loan

With a reducing or flat loan, you pay off more at first. This means that as the balance goes down, your repayments also reduce over time.

Choices Fixed and Choices Floating (including Choices Floating with Offset) home loans can be paid off as a reducing loan.

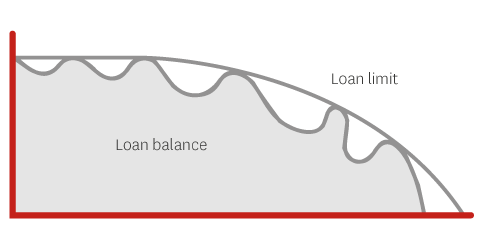

Revolving credit loan

A revolving credit loan combines your home loan and everyday spending into one account. There are no set repayments, but your balance needs to stay below the limit at all times. This means that your balance may fluctuate up and down depending on your spending habits. For this type of loan you are only paying interest on the balance of your loan, not your limit.

As part of a revolving credit facility, you can also choose a small non-limit reducing period. In this scenario, the limit will stay the same for the agreed period and will not reduce. Because you will still have to repay your loan before your maturity date, your limit reduction amount after the non-limit reducing period will be higher than before.

Choices Everyday Floating Home Loan can be paid back as a revolving credit loan.

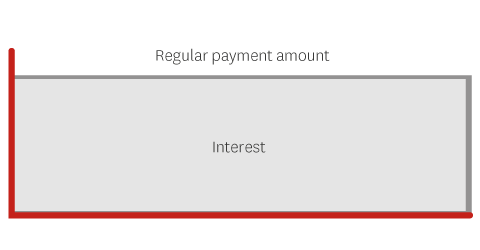

Interest only loan

You can also set up your home loan as an interest only loan but only for a specific period. With an interest only loan, you are repaying only the interest amount as it accrues on your outstanding balance, and none of the principal.

An interest only loan will cost you more interest in the long term than a table or reducing loan because you're not paying off any of the principal during the interest only period.

Because you still have to repay your loan before your maturity date, your repayment amounts after the interest only period ends will be higher. Interest only loans are only available on a short term basis to ensure you can still pay down the loan before your maturity date.

Choices Fixed and Choices Floating (including Choices Floating with Offset) home loans can be paid off as an interest only loan.

Calculators.

Get in touch.

Meet with an expert

Our Home Loan Experts can come to you, when it suits you best.

Apply online.

Existing customers can apply for a home loan via Westpac One® online banking.

Things you should know.

Westpac's home loan lending criteria, terms and conditions apply. A low equity margin may apply.

Documents and fees

See the detailed terms and conditions and fees for our Choices Home Loan:

- Choices Home Loan Summary - Sample

- Choices Home Loan Terms and Conditions

- Transaction and Service Fees

- Westpac General Terms and Conditions

View terms and conditions for all our home lending products here.