Family Springboard.

Leverage equity in property owned by your parents or other family members to buy your first home sooner.

Benefits.

- Buy your first home with support from your family, such as a parent.

- Your family can help you without gifting money.

How it works.

You can choose to structure the loan in two ways: co-borrower or guarantor.

Family Springboard may be an option for you if you have family who can help you with getting into your first home.

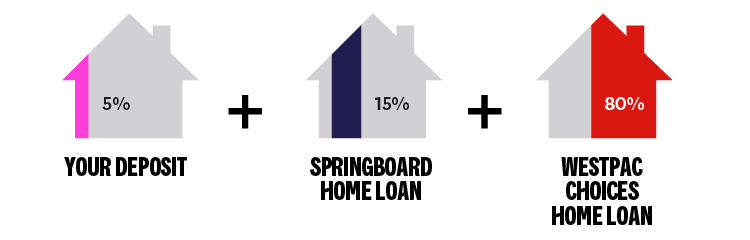

- You will contribute as much as you can towards the deposit to buy your home.

- You can borrow the remaining amount you need for the deposit with Westpac. This will be your Springboard home loan and will be in both you and your family’s names.

- Westpac will also help with the rest of your home loan for up to 80% of the house value. This portion of your home loan can be under your own name only.

Information for you

- You can have less than 20% deposit, but you need to be able to afford the mortgage repayments required for the Springboard home loan and your standard home loan by yourself.

- The home you buy will be under your name only.

Information for your family

- Your family must own their home and have enough equity to support you, because both the home you are looking to buy, and your family’s home will be used to secure your home loan.

- Your family will need to be able to afford the mortgage repayments required for the Springboard home loan, you and your family are both responsible for this loan.

First home buyers' guides.

Speak to a Home Loan Expert.

Have a free, no obligation chat with one of your local home loan experts to learn more about our range of low deposit options, designed to help you into your first home sooner.

Meet face-to-face

Our Home Loan Experts can come to you at a time and place that suits you.

Apply online

Existing customers can apply for a home loan in Westpac One® digital banking.

Calculators.

See all calculatorsHow much can I afford?

Get an idea of how much you could borrow using our affordability calculator.

How much will my repayments be?

Work out how much your home loan repayments might be.

Things you should know.

Family Springboard terms & conditions

- Your deposit (if any) plus the Springboard home loan must add up to at least 20% of the value of your new home.

- You must be able to repay both your own home loan as well as the Springboard home loan.

- Your property must be owner-occupied (you must live in your new home).

- The home you buy is your first home, and you have no other financial interest in NZ property.

- Your family member is agreeing to support your loan obligations to Westpac. If you fail to meet your obligations for any reason, then Westpac may require your family member to meet these obligations for you.

- You and your family member(s) will be jointly responsible for all decisions affecting the Springboard home loan, such as choosing interest rates.

- The property you purchase and any property used for the Springboard home loan must solely be with Westpac.

- Any property you or your family member provide Westpac for the lending will be at risk.

- We recommend you and your family member(s) each seek independent legal advice when considering this option.

- Both you and your family member(s) must provide information about your income and any current debts and meet the standard eligibility criteria and home loan lending criteria, as you both are responsible for repaying the Springboard home loan.

General Home Loans terms & conditions

Westpac's eligibility criteria, home loan lending criteria, terms and conditions apply. A low equity margin may apply.

Documents and fees

- Choices Home Loan Summary - Sample

- Choices Home Loan Terms and Conditions

- Transaction and Service Fees

- Westpac General Terms and Conditions

View terms and conditions for all our home lending products here.