How does credit card interest and interest-free days work?

Whether you're new to credit or just want to feel more confident managing your card, understanding how interest works is a great place to start. This guide breaks it down in a way that’s easy to follow – so you can make informed choices and get the most out of your card.

What is credit card interest?

Interest is what you’re charged when you carry a balance on your credit card. It’s calculated daily and added to your account monthly.

Different interest rates may apply depending on the type of transaction, for example:

- Purchases

- Cash advances (like ATM withdrawals and lotto tickets)

- Balance transfers

- Fees and dishonoured payments.

Knowing when and how interest applies can help you avoid unnecessary costs.

What happens if you only pay the minimum?

Each month, your statement will show a minimum payment. Paying just the minimum is okay if that’s what works for you right now. But it’s good to know that:

- It will take longer to pay off your balance

- You’ll pay more in interest over time

- If you haven’t paid off your balance in full, any new purchases will also start getting charged interest immediately.

If your goal is to reduce interest and pay off your card faster, paying more than the minimum can make a big difference. If you pay off your credit card balance in full you can avoid paying interest.

Let’s say your closing balance is $1,200. If you only pay the minimum payment of $100 by the due date:

- You’ll be charged interest on the remaining $1,100

- Any new purchases will start getting charged interest straight away

- Over time, you’ll pay more in interest and it’ll take longer to pay off your balance.

What is an interest-free period?

Many credit cards offer an interest-free period on purchases – often up to 44 or 55 days. This gives you time to pay off your purchases without being charged interest, as long as you meet certain conditions.

What does “up to 55 days interest-free” actually mean?

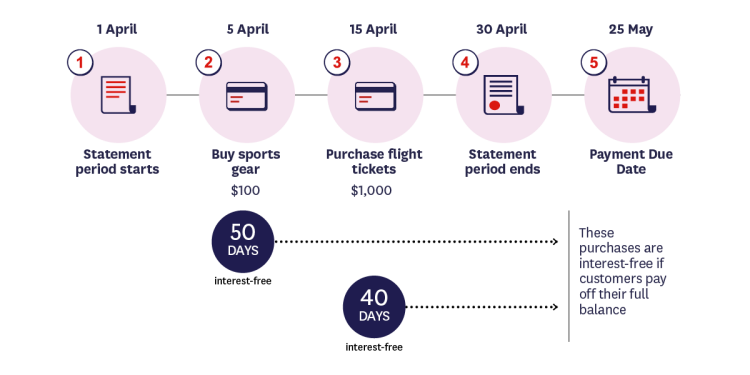

The number of interest-free days you get depends on when you make a purchase during your statement cycle.

It’s important to understand the phrase “up to 55 days”. This doesn’t mean every purchase gets 55 interest-free days. The actual number of days depends on when you make the purchase during your billing cycle.

Your interest-free days usually start from the first day of your monthly credit card bill. You can find this date at the top of your credit card statement.

Here’s how it works:

- 5 April: You buy sports gear. If you pay off the full balance by 25 May, you’ll get 50 days interest free.

- 15 April: You buy flight tickets. If you pay off the full balance by 25 May, you’ll get 40 days interest free.

The earlier in the month you make a purchase, the more interest-free days you’ll get.

Also remember:

- Interest-free days only apply to eligible purchases

- Cash advances (like ATM withdrawals) start charging interest right away.

How to keep your interest-free days

To keep enjoying interest-free days, two things usually need to happen:

- Pay your full closing balance by the due date each month

- Avoid carrying over any unpaid balance from the previous month.

If either of these aren’t met, interest may be charged from the purchase date, even on new purchases. But don’t worry – if you miss a payment, you can get back on track by paying your full balance next time.

How payments are applied

When you make a payment, it’s usually applied in this order:

- Fees and interest charges

- Cash advances and dishonoured payments

- Purchases

- Balance transfers (if applicable)

This means your payment goes toward the highest-interest items first, which helps reduce your interest faster.

What doesn’t count for interest-free days?

Some transactions don’t qualify for interest-free periods. These include:

- Cash advances (e.g. ATM withdrawals, online transfers)

- Quasi-cash transactions (e.g. lotto tickets, money transfers, foreign currency)

- Balance transfers

- Dishonoured payments (when a payment (like a direct debit) is rejected by the payer’s bank).

These usually start accruing interest immediately, often at a higher rate.

Tips to feel more in control.

- Know your statement cycle so you can time purchases for maximum interest-free days. Read understanding credit card statements

- Set up reminders for automatic payments to avoid missing due dates

- Pay your full balance when you can – it helps you stay interest-free

- Check your statement regularly to stay on top of your spending

We can help.

Credit card payment options

There are lots of ways to make payments to your credit card.

Managing Your Money webinars

Our Managing Your Money webinars cover a range of topics and allow you to learn about finances from home.

Things you should know.

This page is for general information purposes only and does not take your financial situation or goals into account.

Credit Cards terms and conditions, eligibility criteria and lending criteria apply. Conditions of Use for the applicable card apply. Rates, transaction and services fees apply.

Balance Transfer Terms and Conditions and lending criteria apply.

Terms, conditions, fees and charges apply to Westpac products and services. See Westpac general terms and conditions for details.