Market ups and downs.

A fall in the value of your investment can be stressful, but you should expect some ups and downs over the long-term.

Be ready for some volatility.

When you invest in a managed fund, or directly in shares, the value of your investment will go up and down. You can see the movement in your KiwiSaver balance, fund unit value, or the price of your shares.

There are lots of reasons for changes in your investment's value, including:

- Companies which are growing profits or dividends will tend to go up in price, and others may fall.

- News about a particular company, nation or industry - good news or results will typically lift the price while bad news may cause it to fall.

- Market sentiment or confidence - how investors are feeling about a particular investment, or about an economy in general, has a strong influence on the market.

- Changes in interest rates, which can affect the value of both bonds and shares

The long term trend is upward - but downturns will happen.

Ups and downs in markets are inevitable, and it can be stressful to see the value of your investment fall.

Despite short term fluctuations, the long-term market trend is upward as economies grow. The long-term market return from the share market have historically been ahead of bonds, which in turn have been ahead of cash deposits and inflation. However, in any given year returns from shares or bonds could be higher or lower or even negative.

Remember that a managed investment fund is not a savings account. Gains are not guaranteed; your balance will fluctuate. A higher-risk growth fund should be expected to achieve higher long term returns but will tend to go up and down more than a conservative or defensive fund. Conservative or defensive funds will also experience fluctuations, to a lesser degree, because they also invest in bonds and shares. That's one reason why it's so important to choose the right KiwiSaver or managed fund that fits your needs.

It pays to stay on track.

When your balance drops, you might feel you want to switch funds or take money out. You might plan to move your money back again after the market has reached its low point. But it's very difficult to pick the top or bottom of the market. It moves unpredictably; just a few vital days of gains, scattered throughout the year, can make a big difference to your investment growth.

A long term investment.

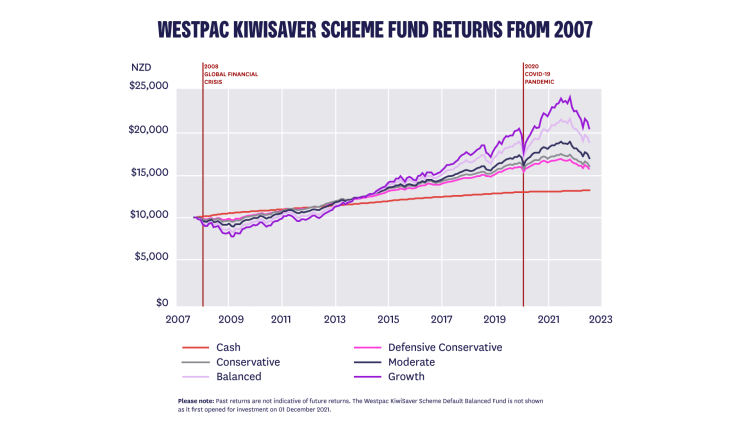

The graph below shows that financial markets do fluctuate, and that over time what goes down generally also goes up – it’s a reminder that KiwiSaver is a long-term investment.

You can learn more about KiwiSaver market ups and downs in our infographic.

The right advice can help.

A Financial Adviser can offer you some perspective when you're feeling anxious about market volatility; they can work with you to set financial targets; consider what risk level you're comfortable with; talk about your money personality; and establish your investment timeline. Everyone's situation is different, so make sure you get advice that's tailored for you.

Next steps.

Talk to an expert

Discuss your investment needs with a Westpac Financial Adviser.

Investment guides.

View all investment guidesThings you should know.

The material on this webpage is provided for information purposes only and is not a recommendation or opinion in relation to investments.

BT Funds Management (NZ) Limited is the scheme provider and Westpac New Zealand Limited is a distributor, of the Westpac KiwiSaver Scheme (Scheme).

The information above is subject to changes to government policy and law, and changes to the Westpac KiwiSaver Scheme from time to time.

Investments made in the Scheme do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BT Funds Management (NZ) Limited (as manager), any member of the Westpac Group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees the Scheme's performance, returns or repayment of capital.

For a copy of the Product Disclosure Statement or more information about the Scheme, contact any Westpac branch or call 0508 972 254 or from overseas +64 9 375 9978 (international toll charges apply). You can also download the Product Disclosure Statement.