Shared Equity.

Want to buy your first home sooner but only have a small deposit? Combine the support of a Shared Equity Programme with a Choices Home Loan.

Benefits.

- You can buy your first home together with a Shared Equity Provider with as little as 5% deposit.

- Own the home together with your Shared Equity Provider and work towards full ownership.

- Save on interest with no additional Low Equity Margin (LEM) added to your interest rate.

How it works.

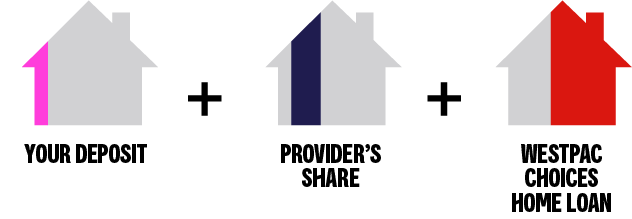

Shared equity splits the cost of financing a home into 3 parts.

- Your deposit: You contribute as much as you can, it needs to be at least 5%.

- Provider's share: The provider can help you with the rest of the deposit you need.

- Westpac Choices Home Loan: Have your home loan with Westpac for up to 80% of the house price.

- Your deposit can be a combination of your own savings, First Home Grant, KiwiSaver First Home withdrawal or gifts.

- The Provider contributes funds to help you buy your home and will own a share of your home equal to the amount they put in, which you can purchase back within the agreed time.

- There will be a shared ownership agreement between you and the provider which has all the relevant terms and conditions that will apply, make sure you read and understand this agreement.

- The provider will support you and help you budget, so you will eventually fully own your home.

How to apply.

- Check if you are eligible1 for a Shared Equity programme and apply directly with your preferred Equity provider.

- Once you have confirmation from your Equity provider, you are eligible and have been accepted into their programme, talk to us to start an application. You can do this in Westpac One®, if you are an existing online customer.

- Westpac will give you a budget to work with as you search for a home, and help you through your first home buying journey.

First home buyer story.

Speak to a Home Loan Expert.

Have a free, no obligation chat with one of your local home loan experts to learn more about our range of low deposit options, designed to help you into your first home sooner.

Meet face-to-face

Our Home Loan Experts can come to you at a time and place that suits you.

Apply online

Existing customers can apply for a home loan via Westpac One® online banking.

Things you should know.

The Equity Provider is normally a non-profit organisation such as the New Zealand Housing Foundation. Certain iwi-led organisations also provide Shared Home Partner programmes to their hapu.

1Westpac's eligibility criteria, home loan lending criteria, terms and conditions apply.

Terms, conditions and eligibility criteria may vary with each Equity Provider. Shared Ownership Agreement terms and conditions apply.

Documents and fees