High Growth Fund.

You’re aiming for the highest possible returns over the long term and you’re comfortable seeing big ups and downs in your balance to get there.

Features.

Risk - the High Growth Fund started on 25 September 2024, so this fund does not have a full five-year return history. To calculate the risk indicator only market index returns have been used. As a result, the risk indicator for this fund may provide a less reliable indication of the funds potential future volatility.

Past performance.

Westpac KiwiSaver Scheme High Growth Fund - #2 Performing KiwiSaver High Growth Fund for 2025

| 3 months | 6 months | 1 year | 3 years | 5 years | 10 years |

| 3.26% | 11.81% | 14.96% | - | - | - |

#2 Performing KiwiSaver High Growth Fund for 2025 is based on the 12 month returns to 31 December 2025 (Morningstar KiwiSaver Survey: aggressive fund category).1

Past performance does not guarantee or indicate future performance; returns will vary and may be negative at times, which means your balance can be less than what you invested.

Returns are after deducting the annual fund charges but before tax to 31 December 2025.

What this fund invests in.

Compare the High Growth Fund.

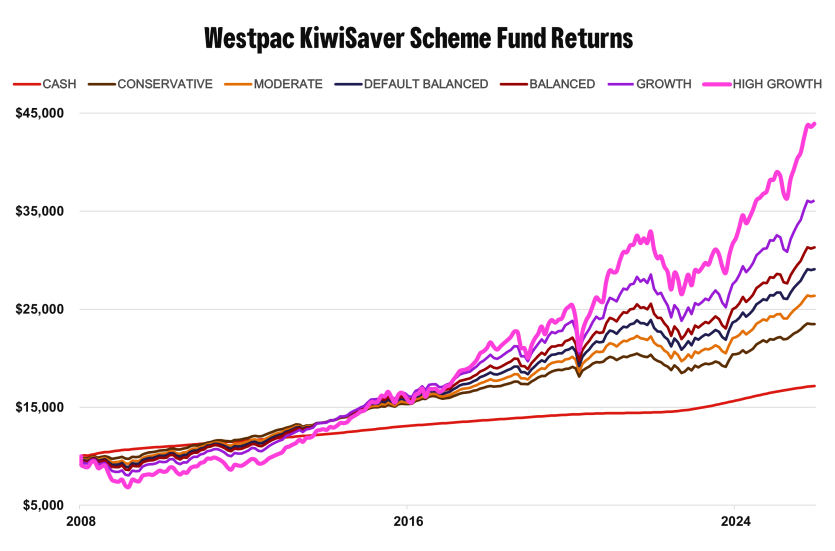

Using modelled returns for the High Growth Fund, you can see that over the long term it has the potential to outperform and generate the highest returns of all our Westpac KiwiSaver Scheme Funds.

Funds that started after 2008, including the High Growth Fund, show modelled returns from 2008 to their start date7. For periods and funds where modelled returns have not been used, returns are after annual fund charges but before tax to 31 December 2025.

What we don't invest in.

Our exclusions are one of the four guiding pillars to our sustainable investment approach. Our policy is to exclude:

| Minimum social safeguards | Companies and other issuers in breach of human rights, labour protection and environmental principles in line with the UN Global Compact2. | |

| Controversial and other weapons | Companies involved in the manufacturing of controversial weapons, or the provision of components or services that are considered tailor-made and/or essential for the lethal use of the weapon. Companies that derive any revenue from manufacturing and selling assault weapons to civilians. | |

| Fossil fuels | Companies that have their primary business activity in the oil and gas drilling, oil and gas equipment and services, integrated oil and gas, oil and gas exploration and production3 or where more than 10% of its revenue is derived from oil and gas exploration, production, or refining (including Arctic exploration, oil sands extraction, and shale energy exploration, extraction and/or production). | |

| Coal mining and production | Companies that have their primary business activity in the coal and consumable fuels subindustries3 or which derive more than 10% of its revenue from the extraction of thermal coal4. | |

| Coal electricity generation | Companies that derive more than 50% of their revenue from generating electricity from thermal coal. | |

| Whale meat | Companies that derive any revenue from the processing of whale meat. | |

| Tobacco | Companies deriving any revenue from the manufacture of tobacco products or companies that distribute their own label tobacco products. | |

| Predatory lending | Companies that derive any revenue from predatory lending practices5. |

Read more about the investment exclusions above, our other exclusions and our sustainable investment approach as one of New Zealand’s Responsible Investment Leaders, recognised by the Responsible Investment Association Australasia (RIAA)6 in 2022, 2023 and again in 2024.

Next steps.

Compare all funds

View, sort and compare all our KiwiSaver funds by fee, return, risk and investment timeframe.

Switch funds

It's easy to switch funds and change contribution rate in Westpac One® digital banking.

Resources.

Things you should know.

1 © 2025 Morningstar, Inc. All rights reserved. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Any general advice or ‘regulated financial advice’ under New Zealand law has been prepared by Morningstar Australasia Pty Ltd (ABN: 95 090 665 544, AFSL: 240892) and/or Morningstar Research Ltd, subsidiaries of Morningstar, Inc, without reference to your objectives, financial situation or needs. For more information refer to our Financial Services Guide (AU) and Financial Advice Provider Disclosure Statement (NZ) at www.morningstar.com.au/s/fsg.pdf and www.morningstar.com.au/s/fapds.pdf . You should consider the advice in light of these matters and if applicable, the relevant Product Disclosure Statement before making any decision to invest. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information. Past performance does not necessarily indicate a financial product’s future performance. To obtain advice tailored to your situation, contact a professional financial adviser. Some material is copyright and published under licence from ASX Operations Pty Ltd ACN 004 523 782.

2 When determining not to invest in a company breaching these principles, we assess the data from our ESG research provider(s), the underlying investment manager’s views and the effectiveness of their stewardship strategies with the company. We may choose to take additional time to divest while we review these factors.

3 As determined by the Global Industry Classification Standard (GICS).

4 For the avoidance of doubt, this exclusion does not apply to the extraction of coking coal, which is used in steel production.

5 As defined by our third party ESG research provider(s).

6 The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold a Financial Advice Provider licence.

7 The Moderate Fund started on 2 July 2014, the Default Balanced Fund started on 1 December 2021 and the High Growth Fund started on 25 September 2024. For the Moderate Fund and Default Balanced Fund, the returns shown in the graph prior to these start dates have been created using actual returns (after deductions for fund charges but before tax) for other funds in the Westpac KiwiSaver Scheme, which have then been adjusted to match the benchmark allocation to growth assets and income assets for these three funds. For the High Growth Fund the returns shown in the graph up to 30 September 2024 have been created using actual returns of the specific underlying asset classes that make up the fund (or a benchmark index where actual returns are not available). We then deduct fund charges so that the returns are shown after the deduction of fund charges but before tax.

The Westpac KiwiSaver Scheme Fund Chooser, and the advice it produces, are provided by Westpac New Zealand Limited.

The material on this website is provided for general purposes only and is not a recommendation or opinion in relation to the Westpac KiwiSaver Scheme. You should not rely solely on the information on this website.

BT Funds Management (NZ) Limited is the scheme provider and issuer, and Westpac New Zealand Limited is a distributor, of the Westpac KiwiSaver Scheme (Scheme).

The information above is subject to changes to government policy and law, and changes to the Scheme from time to time.

Investments made in the Scheme do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BT Funds Management (NZ) Limited (as manager), any member of the Westpac Group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees the Scheme's performance, returns or repayment of capital.

For a copy of the Product Disclosure Statement or more information about the Scheme, contact any Westpac branch or call 0508 972 254 or from overseas +64 9 375 9978 (international toll charges apply). You can also download the Product Disclosure Statement.