How do I join or transfer to the Westpac KiwiSaver Scheme?

You can apply to transfer or join the Westpac KiwiSaver Scheme online in just a few minutes.

You'll need to choose a fund and have your IRD number handy. Once you've applied, we'll take care of the rest.

- Westpac customers: Apply in Westpac One® digital banking by following these steps.

- New to Westpac: Apply on the website.

In the app:

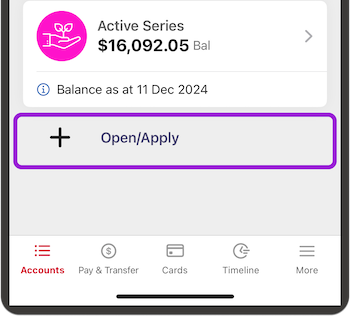

- Go to Accounts, then scroll down and go to Open/Apply

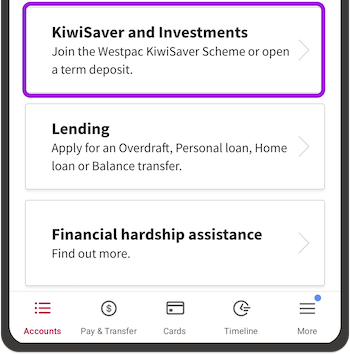

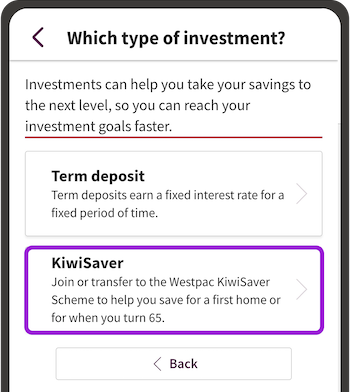

- Go to KiwiSaver and Investments, then KiwiSaver

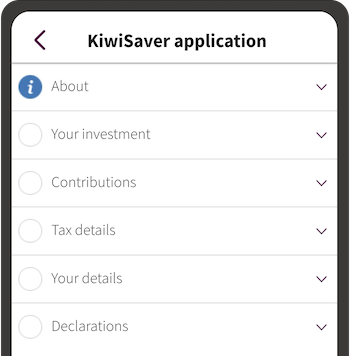

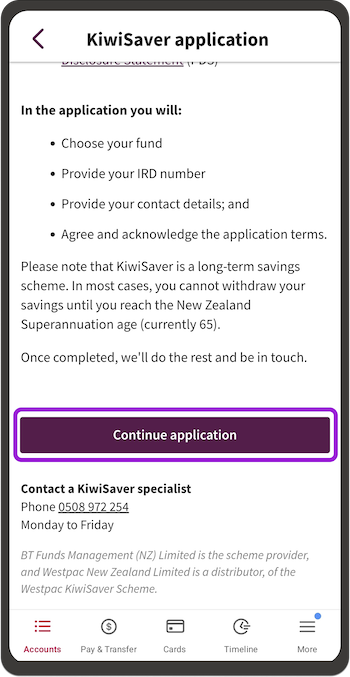

- Go to About, check the details, then go to Continue application

- Then go to Your investment:

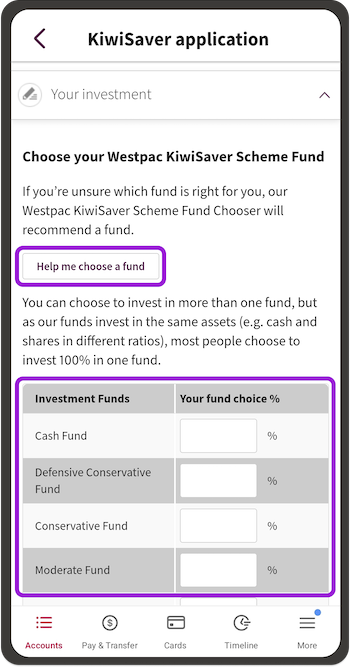

- Go to Help me choose a fund and follow the steps for a recommendation

- To invest in one fund, type 100% in the box next to that fund

- To split your investment, type a percentage into the box next to each fund

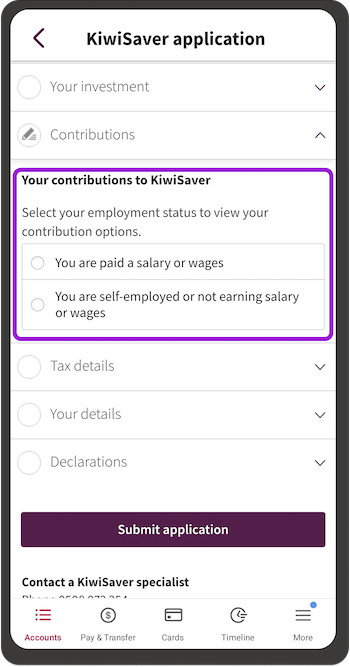

- Go to Contributions, then let us know whether you’re paid a salary or wages

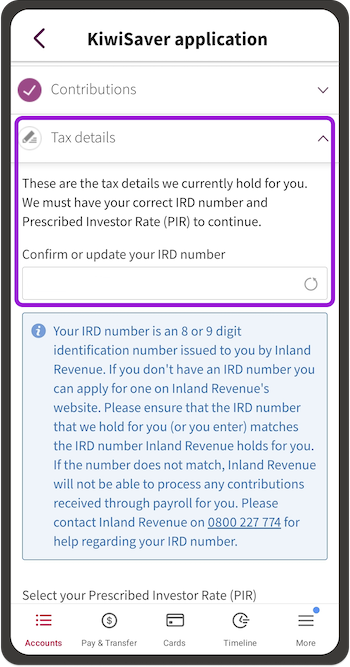

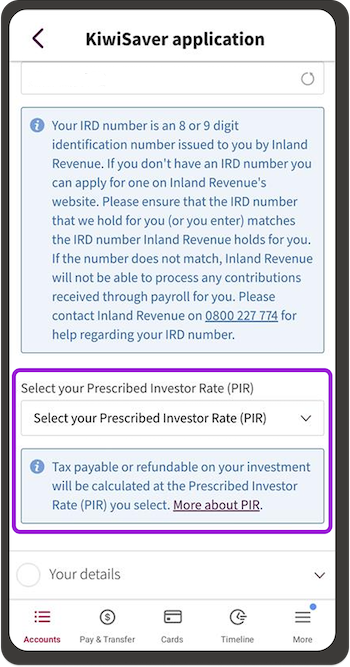

- Then choose Tax details, check or add your IRD number and Prescribed Investor Rate

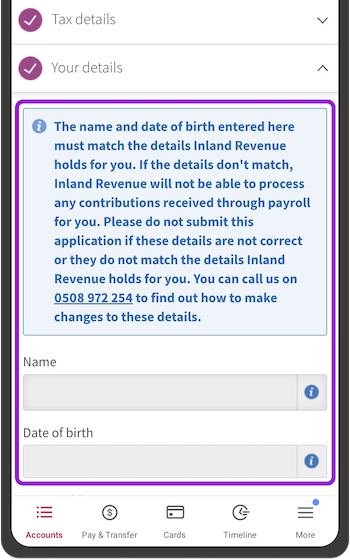

- Go to Your details and check or correct your details

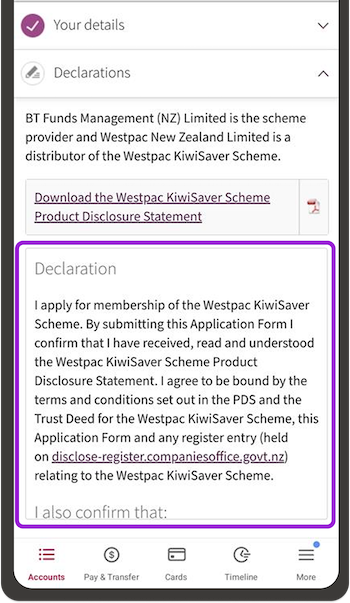

- Then choose Declarations and read the details.

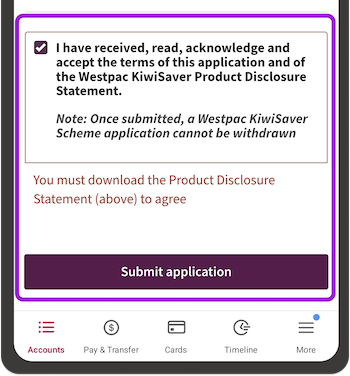

Tick the box to confirm you've read and accept the terms and product disclosure statement, then choose Submit application.

We'll work with IRD (and your previous provider if you’re switching). Your KiwiSaver account will automatically show alongside your other accounts in digital banking when it’s all set up. This can take around 2 weeks.

In online banking:

- Go to Accounts, then scroll down and choose Open/Apply

- Choose KiwiSaver and Investments, then KiwiSaver

- Go to About the Westpac KiwiSaver Scheme, check the details, then choose Continue application

- Go to Your investment:

- Go to Help me choose a fund and follow the steps for a recommendation

- To invest in one fund, type 100% in the box next to that fund

- To split your investment, type a percentage into the box next to each fund

- Go to Contributions, then let us know whether you’re paid a salary or wages

- Then go to Tax details, check or type in your IRD number and Prescribed Investor Rate

- Select Your details, then check or correct your details

- Go to Declarations and read the details.

Tick the box to confirm you’ve read and accept the terms and product disclosure statement, then choose Submit application.

We’ll work with IRD (and your previous provider if you’re switching). Your KiwiSaver account will automatically show alongside your other accounts in digital banking when it’s all set up. This can take around 2 weeks.

On the website.

If you’re new to Westpac, to join through the website you'll need to have handy:

- Your New Zealand driver licence or New Zealand passport

- Your IRD number

- Your mobile phone.

Other ways to join.

In branch

Call us and make a branch appointment. Bring the supporting documents listed at the back of the form with you so we can complete your application.

Post

Download and complete the form at the end of the Product Disclosure Statement. Then return it to us by mail with any supporting documents.

Things you should know.

To join KiwiSaver, you need to be a New Zealand citizen or permanent resident who usually lives in New Zealand

If you’re under 18, you’ll need to download and complete the application form, then either email the team at kiwisaverhelp@westpac.co.nz or call us on 0508 972 254 weekdays between 8.30am and 5pm.

BT Funds Management (NZ) Limited (BTNZ) is the scheme provider and issuer, and Westpac New Zealand Limited (WNZL) is a distributor of the Westpac KiwiSaver Scheme (Scheme). Investments made in the Scheme do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, WNZL or other members of the Westpac group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BTNZ (as manager), any member of the Westpac group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees the Scheme's performance, returns or repayment of capital.

For a copy of the Product Disclosure Statement or more information about the Scheme, contact any Westpac branch or call 0508 972 254 or from overseas +64 9 375 9978 (international toll charges apply). You can also download the Product Disclosure Statement.

![]()