Making your retirement savings work for you.

Once you have access to your KiwiSaver savings, it’s a good idea to have a plan to make your money last as long as possible. With a little help and planning, you can get the most out of your KiwiSaver savings.

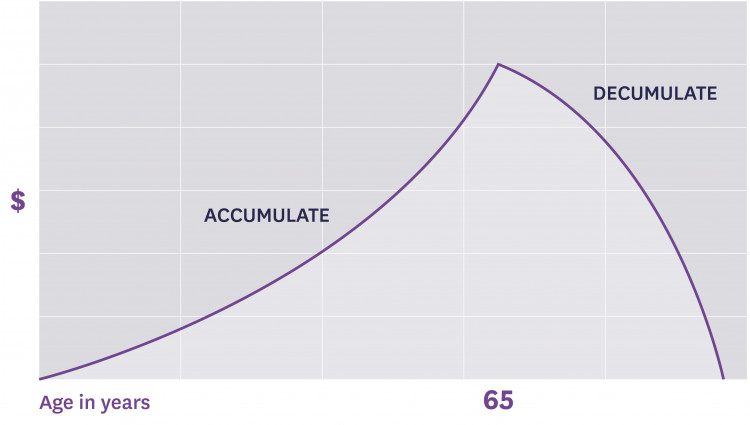

You’ve spent your working years accumulating money for retirement in your KiwiSaver account.

Once you reach 65, you can access your KiwiSaver savings which means you have a few options to consider. Can you afford to spend some of that money now? How do you turn it into a steady income stream for your future? And when will it run out?

After all that accumulation, you’re moving into a new phase: decumulation. Decumulation is when you slowly spend your KiwiSaver money to provide you with a steady quality of life.

This graph demonstrates ‘decumulation’.

It’s not always easy to know what to do with your KiwiSaver savings. You need to find a balance between spending and investing that works for your life. The best approach is to make a plan for how you’ll manage your money after 65, and once you stop working.

By understanding where your income will come from, and how long it needs to last, we can work with you to make a plan that is tailored for your situation.

Thinking about your KiwiSaver savings after age 65

Where will your money come from once you’re over 65? For most Kiwis, the main sources will be:

- Your wages or salary: many New Zealanders keep working into retirement.

- New Zealand Super: currently most Kiwis are entitled to receive superannuation and it’s an important source of money for people when they turn 65.

- KiwiSaver: any funds you’ve accumulated in KiwiSaver are accessible once you reach retirement age (currently 65). You can choose how you want to spend or invest that money.

- Additional Government help may be available to you depending on your circumstances. For example, you may qualify for extra support such as the Accommodation Supplement or the Winter Energy Payment.

- Equity from your home: downsizing to a less expensive home could free up money for you to spend on living costs.

- Savings and investments: you might have savings; or money in an investment fund or term deposit. You might even receive rent from tenants in properties you own or get income from a business.

- Overseas pensions: if you have worked overseas at some point in your life, you may be able to transfer that money to New Zealand. As overseas pensions can be complex, we advise speaking to your accountant.

Knowing how much income you can rely on is really important in planning for your future. Some of this money comes in regularly, while other income might arrive in a lump sum. You need to be able to manage both so you can make the most of your savings – they might need to last 30 years or more.

Creating a plan to manage your money when you turn 65

These are some things you will need to consider:

- What kind of lifestyle you’d like – having a realistic plan for your future.

- How much regular money is coming in, such as New Zealand Super.

- How you want to use your KiwiSaver savings – for example, you might keep investing, withdraw some of it, receive monthly payments, or a combination of all three.

- How much you might be able to rely on from other investments like managed funds.

- What point you are at in your retirement (spending tends to reduce as we age).

- If you might downsize a home to free up money for other things like expenses.

- If you’d like to leave any money for the next generation.

With a good sense of your financial position and having considered things like health and home equity, you can plan exactly how you can afford each year in retirement. Your plan will need to be reviewed and adjusted over the years, but it should give you confidence in your financial position and hopefully stretch your funds out for as long as they’re needed.

Our Westpac Financial Advisers are available to help you create a roadmap for your future, so you can make the most of your KiwiSaver savings. This is a free service for all Westpac and Westpac KiwiSaver Scheme customers, so together we can create a plan for managing your money after you turn 65

Get in touch with a Westpac Financial Adviser.

This service is free to all Westpac customers, and we would love to hear from you.

KiwiSaver guides

See all KiwiSaver guidesThings you should know.

The article above is provided for information purposes only and is not a recommendation or opinion in relation to the Westpac KiwiSaver Scheme or any other financial advice product. We recommend that before acting on any general information, you consult a Westpac Financial Adviser or other financial advice provider for financial advice that takes into account your particular investment needs, objectives and financial circumstances. The information above is subject to changes to government policy and law, and changes to the Westpac KiwiSaver Scheme from time to time.

BT Funds Management (NZ) Limited is the scheme provider and Westpac New Zealand Limited is the distributor, of the Westpac KiwiSaver Scheme (Scheme).

Investments made in the Scheme do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BT Funds Management (NZ) Limited (as manager), any member of the Westpac Group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees the Scheme's performance, returns or repayment of capital.

For a copy of the Product Disclosure Statement or more information about the Scheme, contact any Westpac branch or call 0508 972 254 or from overseas +64 9 375 9978 (international toll charges apply). You can also download the Product Disclosure Statement.