Small business budgeting & forecasting.

It’s time to run some numbers on your business idea. Budgeting and forecasting help with that.

What is a budget?

A budget predicts how much money will come and go from your business over a period of time (usually a year). Budgeting and forecasting help startups see if they can afford to start a business – and if it will repay all their hard work with a return on their effort.

The purpose of a budget

Budgets predict the money-making potential of a business, but they also tell you things like:

- How much it will cost to start up

- Whether you’ll need to borrow money

- Your breakeven point

- What you need to charge customers

- If you can afford staff.

How to make a budget

Start off by listing your costs and note roughly when they’ll hit. The timing is important to small business budgeting because it affects your cash flow. Do the same for income.

Budgeting is so nice, you ought to do it twice

Make a budget that assumes a solid first year, and another that assumes a slow start. That second budget won’t be so much fun to create, but you’ll be glad to have it up your sleeve if things don’t take off. Bank managers and investors will also want to see two budgets.

“Reduce financial risk by validating your business idea first. For example, you could open a pop-up store first, instead of paying for the fit-out of a retail store” - Bean Ninjas

Small business budgeting mistakes to avoid.

Don’t forget to deduct sales and income tax from sales revenue.

Some jobs go wrong, and some inventory gets broken so build in contingencies.

Remember to calculate how much interest you’ll pay on loans.

Factor in costs to insure your business against liabilities and disasters.

Put money aside to cover depreciation of assets like work tools (because you’ll have to replace them eventually).

Creating a financial plan for your business.

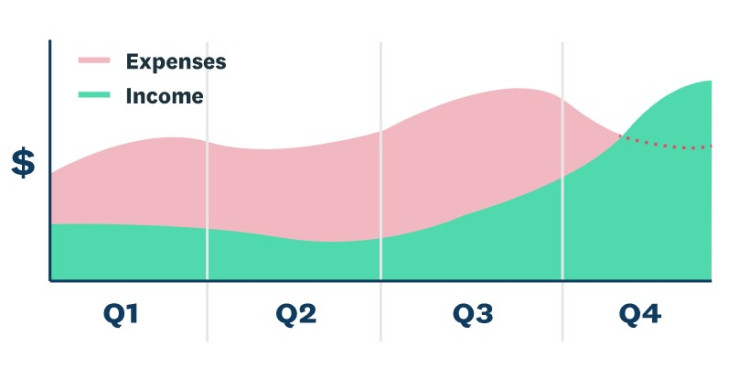

Try not to freak out about this red part of the graph.

That’s just part of being a startup and will appear in most small business budgets. It will take time for customers to find and trust you, so sales will be slow in the beginning. Meanwhile you’ll have a lot of set-up costs to contend with.

Include a section in your business plan on how you’ll make up the difference. Will you dip into personal savings? pitch investors? go to the bank? or turn to family and friends?

The difference between a budget and a forecast

Budgeting and forecasting are often treated the same, but there are important differences. Small business budgeting shows how you expect the business to perform over a given period. Forecasts use real-life sales and cost data to show where things are actually headed.

For obvious reasons, you want to know if the two are seriously out of whack. So check your budget against actual business numbers regularly. That way you can fix problems before they get too big, and spot opportunities before they’re missed. Plus the exercise will help you get better at estimating costs and income for the years ahead. Small business budgeting and forecasting go hand in hand.

“It’s important to not only budget for costs that occur monthly, but also the costs that happen once or twice a year. Don't get surprised by a big lump sum insurance payment, for example”. Accountingprose

Get help from an accountant or bookkeeper

Accountants and bookkeepers work with small businesses all day, every day. They can help get your numbers right.

Things you should know.

The opinions expressed on this page are not necessarily those of Westpac and Westpac does not endorse or approve any goods or services to which reference is made. Westpac makes no representation as to the accuracy or currency of the materials, which are provided without taking your personal financial situation or goals into account. Westpac accepts no responsibility for the availability or content of any third party material to which this page may refer.

Any tax information provided in this webpage is general in nature and for illustrative purposes only; it does not constitute tax advice and should not be relied on for tax purposes. You should seek professional advice on the tax implications of your investments based on your particular circumstances. Westpac accepts no responsibility for the tax consequences of investments to you or any third parties.

Originally published by Xero. Find out more about Xero's accounting software for your small business.