2025 sustainability update.

We see sustainability as taking care of our financial, social and environmental responsibilities to our customers, communities and people we work with. We want to help our customers remain resilient and thriving – now and in the future.

Our purpose.

Mahia ināianei mō āmua ake.

Taking action now to create a better future.

Highlights.

Helped our customers shop more safely online with our new digital debit and credit cards with dynamic security codes (CVC).

Increased banking access for customers experiencing vulnerability via our new basic bank account pilot.

Supported Australasia's first Sustainability-Linked Bond linked to a nature-based target, issued by Auckland Council.

Helped improve in-person access to banking in the regions by piloting new community banking initiatives, including a community banking van.

Helped grow financial confidence in our communities, reaching more than 13,000 participants through our Managing Your Money workshops.

Fundraised a record $1.5m for NZ's rescue helicopters through our annual Westpac Chopper Appeal campaign.

A note from our CEO.

About this update.

Our 2025 Sustainability Update shares progress on our 2027 Sustainability Commitments and details how we're responding to our material topics. Material topics are the areas of our business which matter most to our stakeholders. We identify material topics through a sustainability materiality assessment every two years.

This update supplements other reports for Westpac Group and Westpac NZ. For more information, see our reporting suite below. For information on BTNZ, which is responsible for the investment of the Westpac NZ KiwiSaver Scheme, see the Sustainable Investment page.

All figures and commentary are for the 12 months ended 30 September 2025 unless otherwise stated. All dollar amounts are in New Zealand dollars, unless otherwise indicated. All references to years refer to our financial year which is 1 October to 30 September.

Our 2027 Sustainability Commitments.

Our 2027 Sustainability Commitments build on the progress we have made since 2009, when our first sustainability strategy was published. They guide how we show up for our customers, communities and Aotearoa.

Our commitments focus on three areas: powering a sustainable New Zealand; being fierce advocates for inclusion; and caring for customers and communities.

Ko ngā muka o te harakeke te whiringa nui o te ao.

All the threads that bind us together for a greater world.

Power a sustainable New Zealand. Whiria te muka tāngata.

Support a low-emissions, climate–resilient and nature positive future.

1. Increase sustainable lending to $9 billion at 30 September 2027 to support our business customers to achieve positive social and environmental outcomes.¹

See the sustainable finance section for more.

2. Continue to reduce operational emissions in line with 1.5°C, reduce our financed emissions, and support our customers to transition towards net-zero.²

See the climate change section for more.

Fierce advocates for inclusion. Whiria te kotahitanga.

Enhance financial inclusion and independence of New Zealanders.

3. Support the financial wellbeing of New Zealanders through 40,000 interactions providing education, additional safe and equitable banking services, and extra care to customers in need between 1 October 2024 and 30 September 2027.³

See the financial difficulties and financial capabilities and resilience sections for more.

Care for customers and communities. Whiria te manaaki tāngata.

Help our customers and local communities thrive.

4. Invest $30 million in the community, including Westpac New Zealand staff using 100,000 hours of volunteering leave, between 1 October 2024 and 30 September 2027.⁴

See the customer trust and expectations section for more.

5. Increase lending in support of affordable housing solutions by $1 billion at 30 September 2027.⁵

See the sustainable finance and customer trust and expectations sections for more.

Case studies.

Our material topics.

Westpac NZ’s material topics help inform our annual Sustainability Update and our 2027 Sustainability Commitments.

In 2024, Westpac NZ undertook a sustainability materiality assessment to identify topics that matter most to our external stakeholders and Westpac NZ. This process was undertaken with the support of an external consultant, using a methodology aligned with the Global Reporting Initiative (GRI) and emerging international reporting standards.

In 2025, we considered our current and emerging risks, along with the media landscape, to determine if the 2024 sustainability materiality assessment was still relevant. We subsequently retained the assessment from 2024, noting shifting political sentiment towards climate action and escalating geopolitical tensions.

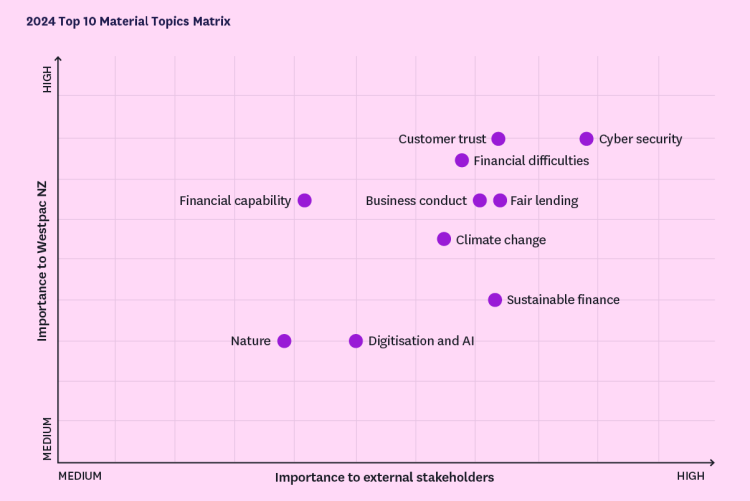

The top 10 topics by importance to Westpac NZ internal and external stakeholders were mapped in 2024, as set out in the chart below.

Caption: In 2024, our materiality assessment showed cyber security was the most important topic for our stakeholders, followed by customer trust and financial difficulties.

The following sections provide more details of how we're responding to our top 10 material topics.

Power a sustainable New Zealand.

Fierce advocates for inclusion.

Care for customers and communities.

Foundations.

Looking forward.

Get in touch.

Our reporting suite.

This update is part of a suite of sustainability reporting from the Westpac Group. For more information, refer to:

- Westpac New Zealand Environmental, Social, Governance Dashboard

- Westpac New Zealand Climate Report 2025

- BT Funds Management (NZ) Ltd – Sustainable Investment Report

- Westpac Group annual reporting suite

We're committed to regular and transparent reporting to enable stakeholders to compare our relative performance over time. See our previous sustainability updates:

Things you should know.

Product Disclosure: Where loan products are discussed in this update, lending criteria, terms and conditions apply to these products, which may be subject to change from time to time. Fees and charges may also apply. See our product pages for further details: Greater Choices Home Loan, Sustainable Business Loan, Sustainable Farm Loan, Sustainable Equipment Finance Loan, and EV Loan.

This sustainability update contains forward looking statements. These statements are not certain and are subject to known and unknown risks and uncertainties, which are, in many instances, beyond our control. We give no representation, guarantee, warranty or assurance about the future business performance of Westpac NZ, or that the outcomes expressed or implied in any forward-looking statement made in this document will occur.

The information in this sustainability update is given in summary form and does not purport to be complete. The material in this update is provided for information purposes only and is not advice, recommendations or opinions in relation to any Westpac NZ products or services. The information in this update is general, and does not take into account the investment objectives, financial position, or needs of any particular investor or customer. Westpac New Zealand Limited.

In this update, ‘Westpac NZ’ and ‘the bank’, ‘we’ and ‘our’ refer to Westpac New Zealand Limited. ‘Westpac Group’ refers to Westpac NZ’s parent, Westpac Banking Corporation (ABN 33 007 457 141) and its consolidated subsidiaries.