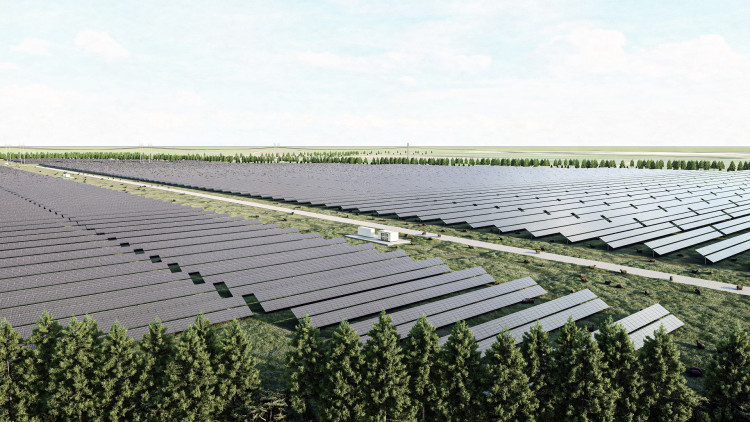

Late next year, New Zealand’s electricity grid will draw down its first power from a large-scale solar power station, as Lodestone Energy switches on the new installation near Kaitaia.

The site will generate 47 GWh – enough to power roughly 5,500 homes annually – and is the first of five solar plants planned by Lodestone.

Once built, the installations will collectively generate 265 GWh per year.

The plants will help to diversify the range of power sources feeding into the grid and is another step in the country’s transition to a lower carbon future.

Westpac is proud to be the sole senior debt provider of what will be a transformational project.

We believe renewable energy is key to powering a sustainable and prosperous future for Aotearoa, as more of the economy electrifies and the demand for low or zero emissions energy grows.

We’re fortunate that New Zealand already has a strong renewable energy foundation.

Electricity from hydro power stations have been lighting up homes and businesses for decades and the amount of renewable energy being utilised by Kiwis and the commercial sector around the motu is growing.

With the country’s push to reduce greenhouse gas emissions and the need to diversify the energy sector and transition away from fossil fuels, the role of affordable and accessible renewable energy will only grow.

A more diverse energy sector with more renewables will ultimately help Kiwis’ back pocket through increased competition and greater choice.

Boston Consulting Group noted in a recent paper – The Future is Electric – that the pace of development is key for New Zealand to meet its emissions reduction targets.

It noted the electricity sector “can help reduce 70% of carbon emissions required” by the net zero carbon target. It says “unprecedented investment” is required.

But as a tumultuous 2022 draws to a close there’s no smooth path in the years ahead for developing renewable energy.

The world is facing uncertain times, with strong economic headwinds and rising interest rates.

In the short term these conditions are likely to deter investment in renewable energy projects that are not already out of the starting blocks.

However, it is important the pipeline of work remains full as new infrastructure can take many years to scope, design, fund and consent, and that’s before shovels even go in the ground.

Because the lead times are lengthy, we need to look through the economic cycle and plan for the decarbonisation that is coming as we respond to climate change.

Regulatory barriers remain in place including complex Overseas Investment Office (OIO) and resource consent processes.

A recent consultation paper by the Electricity Authority noted the OIO requirements were a “key concern” for overseas developers wanting to do business here. The Authority recommended the OIO publish guidance for overseas investors by the end of this year and provide a helpdesk for them.

According to a Treasury Report in 2019 the OECD compared 68 countries and rated New Zealand’s OIO regime the seventh most restrictive.

New Zealand’s abundance of sunshine and wind coupled with a relatively underdeveloped renewable energy sector lends itself as an appealing proposition for overseas investors.

But we need to make it as easy as possible for overseas businesses to start new renewable energy projects here. A simple and fast OIO process will go a long way to helping this happen.

Westpac NZ welcomes reforms to OIO processes in recent years but notes that in September a bill to exempt investors from OECD countries from OIO approval (except residential land investments) was rejected by Parliament.

We hope the Government’s plan to repeal the Resource Management Act (RMA) will also lead to a more streamlined process for businesses wanting to invest in the sector.

As the three-year point of living with COVID-19 fast approaches, the pandemic is still having a negative effect on the economy. Increased costs from supply chain issues are still hitting local businesses hard and employers continue to see staff off work with illness.

With no end in sight to the war in Ukraine, European countries are increasing renewable energy growth to reduce dependence on Russian gas – tying up materials supply and absorbing the specialist labour force who are necessary to make these projects happen.

Solar and wind-generated electricity in the European Union increased by a record 13% from March to September amid the conflict, according to energy think-tanks E3G and Ember.

Dr Chris Rosslowe, senior analyst at Ember said renewable electricity helped buffer Europe “from an even worse energy crisis”.

Netherlands, Austria, Denmark and Portugal are all aiming to have 100% renewable production of electricity by 2030.

Westpac is forecasting that inflation will still be around 4% by the end of next year and won’t fall back within the Reserve Bank’s 1-3% target range until well into 2024.

These inflationary pressures are driving up the cost of materials for renewable energy projects.

The cost of steel is soaring and a number of raw materials needed for solar and wind are forecast to be in short supply, including copper and nickel. Labour cost and availability is also challenging.

A paper by Principal Economics about the cost of delays in infrastructure noted that the cost of delays in the Waikato Expressway alone have seen foregone benefits of $2.3 billion or 1.2 times the capital cost of the project.

So what needs to happen to accelerate growth in our renewable energy sector?

Westpac NZ believes there is scope to reduce bank capital requirements for green assets.

The Government is implementing higher capital requirements over the next seven years to try and bolster banks’ ability to withstand global shocks like the pandemic.

Despite the barriers and sometimes slow progress in expanding renewable energy in New Zealand we are optimistic for the sector and can see light on the horizon and recognise recent OIO reforms and planned RMA reforms should make things easier.

Westpac NZ has been looking at opportunities in the electricity sector to help New Zealand meet its emissions reduction goals. We are financing a number of renewable energy projects which contribute towards the announced pipeline of approximately 10GW of additional electricity generation capacity. These projects include many new and smaller generators with only 50% involving the country’s top 5 electricity providers.

Renewable energy is a crucial sector for Aotearoa’s future and Westpac NZ wants to support it to make it grow.