House prices are still set to boom in 2021

Residential construction is booming, net migration into New Zealand is close to zero, yet house prices are still set to boom in 2021, says Westpac Chief Economist Dominick Stephens.

And that’s mostly down to one factor: low interest rates.

“Low interest rates are more influential on house prices than the supply of housing and the past year has been living proof of that,” Stephens told REDnews.

“We have almost zero net migration and high levels of construction, but house prices are booming, so we see low interest rates are more influential than anything else.

“Supply and demand is a factor though and the housing shortages are unwinding rapidly. In time we think that will be shown in a lower rate of increase in rents.

“Housing shortages impact both rental and buying prices,” he said.

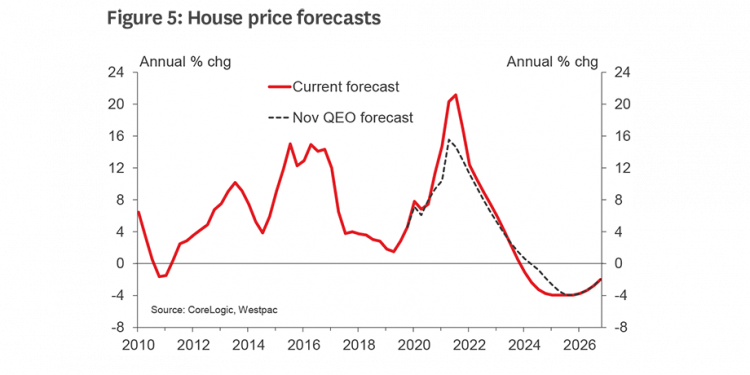

Dominick Stephens and his team of economists have forecast 17% house price inflation in 2021.

“Our forecast is 7.5% house price inflation for 2022. But we are expecting house prices to decline by about 4% per annum in the middle of the decade,” he said.

The team believes mortgage rates have reached their lows and long-term interest rates will start to increase as global economic sentiment improves.

In its latest Quarterly Economic Overview, Stephens’ team said: “We expect house price inflation to turn negative by 2024.”

So, what does this mean for owners and buyers?

“If house prices fall, it’s bad for those who own, but good for people buying,” Stephens said.

“It could be nasty for people who have recently bought because they will find the interest cost rises much higher on their mortgage.

“This will crimp their budget for other spending and in turn crimp the economy – that’s what happened in 2007, just a year before the collapse of Lehman Brothers,” he said.

Despite the Reserve Banks’ tightening of loan-to-value restrictions coming into play in just weeks, the effect on current house prices will be a small one, the team wrote in their report.

According to the latest data in February from the Real Estate Institute of New Zealand (REINZ), median house prices across New Zealand increased by 19.3% from $612,000 in January 2020 to $730,300 in January 2021.

Median house prices for New Zealand excluding Auckland increased by 14.7% from $525,000 in January last year to $602,000.

Auckland’s median house price increased by 14.9% from $870,000 at the same time last year to $1,000,000.