New GST rules mean that online shopping could see a hike in fees

As of 1 December 2019, overseas companies selling goods to Kiwi customers started collecting GST on all products valued under $1,000, under a new Customs rule.

Under the former rules, GST was not typically collected on imported items under the value of $400, but the new laws have been under debate since the growth of the e-commerce industry.

There is one silver lining to the new GST rules though, if your online shopping bill includes less than $60 of Customs fees, then it will be waived.

However, if the amount to be paid to Customs is more than $60, you will also have to add on duty, plus GST, plus and an import entry transaction fee and MPI levy, according to NZ Customs.

“Customs will collect 15% GST and tariff duty on imported items, including anything bought online from overseas, where the total amount of GST and tariff duty on the purchase equals NZ$60 or more,” they say.

Alcohol, tobacco and fine metal aren’t included in this threshold though.

The changes mean that products under $400 will be more expensive to buy online, but products between $400 and $1000 will end up being slightly less.

This leaves online shoppers wondering which items are actually worth ordering from foreign websites such as Amazon, Alibaba and eBay.

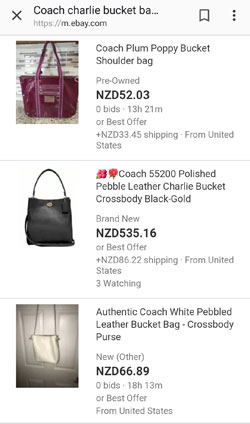

Prior to December 2019, for example, if a consumer bought books through Amazon for $60 including shipping, the duty fees would be waived. However, if they bought a $621 Coach Charlie Bucket handbag from eBay, including the $86 shipping fee from the US to New Zealand, they would be stung with a bunch of other costs.

The total bill would have added costs including an estimated $26.75 in duty, $84.26 for the 15% GST, $12.90 for GST on freight, and $52.67 in entry fees.

That is an extra $176.58 to the cost after buying the bag with shipping fees, making the total fee $797.58. The same bag bought from the Coach store in New Zealand costs $770, so the consumer would actually save $27.58 by shopping domestically, which is exactly the point of the GST.

But now, the extra fees on the handbag would be waived in that price bracket, so it would be cheaper to buy that product online than in store in New Zealand.

The aim of the tax hike is to protect local business, by charging foreign companies the same threshold as domestic businesses.

Revenue Minister Stuart Nash said that many New Zealand small businesses were in competition with foreign firms who sold exactly the same products into our market without collecting GST.

“Domestic businesses have long called for greater fairness in the treatment of low-value goods from offshore retailers,” Nash said.

“With steady growth in online shopping from offshore suppliers, a significant amount of tax revenue is also being lost.

“Mostly though, it’s a matter of fairness so the sooner we get this the better. This measure aims to help level the playing field and improve the integrity of our tax system.”

The new changes are expected to bring in an extra $218 million in tax revenue by 2022.

Some retail giants, however, believe the move will reduce New Zealanders access to a competitive market and not all overseas companies are expected to comply straight away.

Amazon’s Matt Levey, who is the shopping giant’s local public policy head, wrote a joint letter to Parliament’s Finance and Expenditure Select Committee along with other large retailers such as eBay and Alibaba earlier in the year.

Levey wrote that Amazon was “concerned that an unworkable GST collection model will harm NZ consumers by potentially reducing access to competitively priced goods from overseas marketplaces,” as reported in Stuff.co.nz.

However, the increased taxes don’t seem to bother all avid online shoppers. Westpac customer Camellia Yang is devoted to sites such as Shopbop, Farfetch, Ssense, Tmall and brand official websites.

“I use these websites for items that I cannot find locally in New Zealand or for specific sizes, colours, and styles that aren’t available here,” Yang said.

“I mostly buy clothing, shoes, and sometimes gifts online and I enjoy using these sites so much to get exactly what I want that I’ll continue to use them even if taxes increase,” she added.

New Zealand Customs say they encourage anyone buying goods from overseas to check their online duty estimator to learn about costs and also prohibited and restricted items before shopping online.