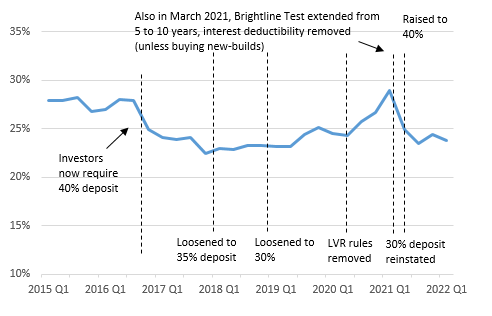

Tighter borrowing rules targeting property investors have really helped reshape the housing market, according to data from Core Logic.

When the Government introduced a 40% LVR in 2016 – meaning investors had to have 40% equity in any new purchase - there was an immediate impact on the market with the share of sales to investors sharply declining.

Since then, LVR rules were eased over 2018 and 2019, removed in 2020, and then in 2021 re-implemented again.

CoreLogic track the share of sales to investors, and when the numbers are lined up with the policy changes as in this table below, it’s easy to see the effects these have had since 2015.

While LVRs certainly make a difference, it appears the restrictions have to be at a high enough rate to make a dent in sales volumes.

“I don’t know what it is, but it seems something about 40% certainly makes it meaningful,” says Kelvin Davidson, Chief Property Economist at CoreLogic.

“We saw some evidence previously that 20%, 30% doesn’t have quite the same impact that the 40% does.

“We saw it in 2017 as well, such a marked change in the investor market share. Of course, this time it has been compounded by loss of deductibility, the tax changes that were made in March last year, but I’d certainly credit most of it to the 40% deposit.”

Without investors, who benefits?

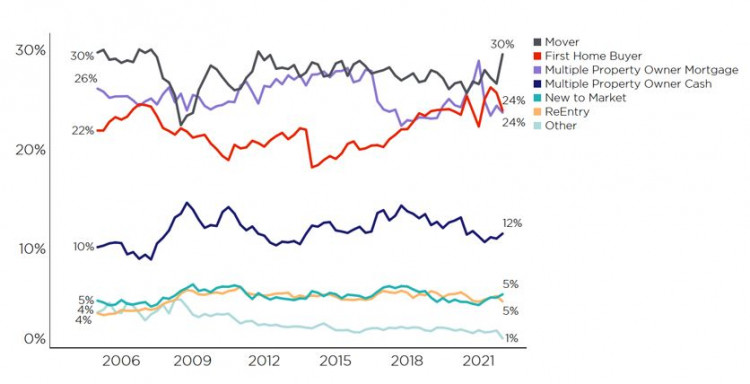

When comparing all the types of buyers over the same period as the regulatory changes, most other segments – cash investors, new to markets, and reentries – are relatively stable.

This Corelogic table shows the percentage of sales to each segment since 2006 and you can see in recent years especially how the movements of one segment can reflect on another one.

So who is filling the gap left by investors?

“It tends to be when mortgaged investors are finding it tougher, first home buyers are able to access the market,” Kelvin says.

“And partly that’s to do with when investors are hit harder by lending rules, first home buyers aren't hit as hard, so they can trade a bit more easily.”

Kelvin believes the reason movers stay stable while first home buyers see movement is due to the types of homes they are buying.

“It’s sort of a little bit hard to prove, but certainly what people believe is investors and first home buyers tend to be in the same parts of the market, tending to look at the same properties.

“So if one group has been knocked out a little bit by lending rules, the other group will be there to pick up the pieces. They are looking at entry level, three-bedroom houses. Similar properties, similar value bands, so it makes sense when one of those groups does tail off a bit the other steps in.”

However, in the past couple of months, the numbers of First Home Buyers have dropped dramatically.

“Perhaps the most notable recent shift has been for first home buyers, who only had a 23% share of purchases across Q1 as a whole, and 21% in March itself.

“Apart from the lockdown-affected April 2020, the latest figure is the lowest monthly share for FHBs since the second half of 2017.

“This abrupt shift only started in January (their share was still 26% in December), clearly a reflection of November’s tightening to the LVR rules and December’s CCCFA law changes.”

At the same time, Kelvin says ‘Movers’ are having a bit of a growth period.

“Movers are another key group of interest, with these relocating owner-occupiers taking a 27% share of purchases in March and 29% for the first quarter as a whole.

“That quarterly figure is the highest since 2016, and has been helped by more listings being available (making it more likely that movers can actually find a property they like), but also by their longer period in the market and increased equity base.”

Are investors off-loading their properties?

With yields getting lower, costs increasing, and tax benefits reduced, are we seeing an influx of investment properties hitting the sales market? Especially when you see that there are currently higher than normal listings on the market.

“There’s no real evidence of that,” Kelvin says.

“If you look at overall listings, the total stock on the market has risen, so in general we have seen the market free up, there’s more properties available for sale, but that’s not due to a big influx of new listings.

“The new listings coming on the market each week or each month have been pretty normal for this time of year, but what’s happened is that sales have fallen away.

“You’re losing fewer through sales, you’ve got a steady flow of new properties coming on, and so the total on the market has a chance to replenish, so the mechanics of it is more due to a fall in sales rather than a rise in new listings.”

Despite that, Kelvin says he wouldn’t be surprised to see more investment properties hit the market later this year.

“It could change over the next 6 to 9 months as perhaps some investors do start to think, ‘This could be as good as it gets’.

“They might be having to top up the property each week to keep it breaking even, the scope for capital gains has gone down, and perhaps if they’re outside their Brightline period as well, so some of those people might look to sell.

“That’s something I’ll be keeping an eye out for this year.”