Sustainable investment.

Our approach to sustainable investment and what this means for investors.

Responsible Investment Leader 2022, 2023 and 2024.

BT Funds Management (NZ) Limited (BTNZ) is the investment arm of Westpac in New Zealand.

Our investment schemes (including the Westpac KiwiSaver Scheme, Westpac Active Series and Westpac Retirement Plan) are invested in line with our Sustainable Investment Policy. This means we incorporate environmental, social and governance factors throughout our investment process. We do this to help us better manage investment risks and pursue investment opportunities, while contributing to positive environmental, social, and economic outcomes.

We’re proud to be recognised as one of New Zealand's Responsible Investment Leaders for 2022, 2023 and 2024 by the Responsible Investment Association Australasia (RIAA). RIAA has also certified our Westpac KiwiSaver Scheme funds and Westpac Active Series funds (except for the Westpac KiwiSaver Cash Fund as RIAA does not certify cash funds)1 according to the operational and disclosure practices required under the Responsible Investment Certification Program. See responsiblereturns.com.au for more details.1

We believe that it is important to measure and transparently disclose our progress in implementing our Sustainable Investment Policy. You can see how we’re progressing in our Sustainable Investment Report and in our Climate Statements. As a signatory to the United Nations Principles for Responsible Investment you can also view our latest Transparency Report.

How we invest sustainably.

Our approach to sustainable investing has four pillars:

- Exclusions

- Environmental, Social and Governance (ESG) integration

- Stewardship

- Sustainable themes.

Our exclusions.

We aim to avoid investment in companies or other issuers2 that are identified as operating outside of our sustainable investing criteria.

We mainly rely on research from our third-party ESG research providers to help us determine where a company is operating outside our exclusions criteria. Where appropriate, we may use other information sources and/or our own assessments. You can learn more about how we manage our exclusions in our full Sustainable Investment Policy.

We aim to exclude:

About our exclusions.

Exclusions criteria are applied where we hold securities directly. In the rare instance where we use third-party funds or exchange traded funds, we aim to align our exclusions as closely as possible to our Sustainable Investment Policy and at a minimum apply our fossil fuel, tobacco and weapons exclusions. For derivative instruments, the reference index for the derivatives contract may include exposure to excluded securities and, where possible, we will seek to choose contracts which incorporate our exclusions.

Implementation of these exclusion criteria can be affected by the accessibility and accuracy of data, or an error by an external service provider or investment manager. This may result in inadvertent holdings in investments we are seeking to exclude. In this event, as soon as this has been identified, the investment manager is required to divest within ten business days.

For details on how we manage our exclusions please refer to our full Sustainable Investment Policy

ESG Integration.

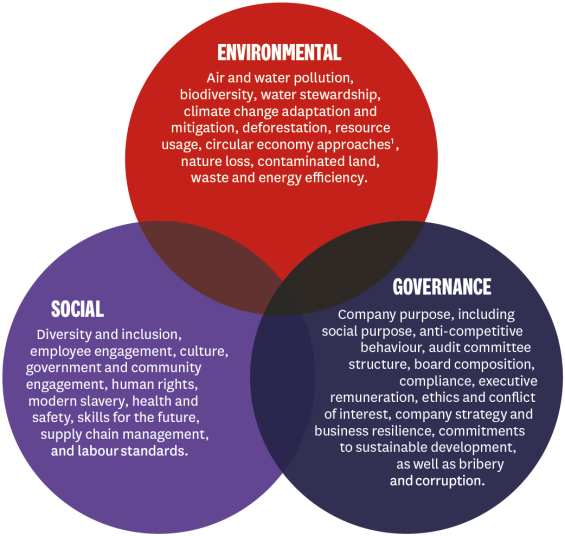

ESG integration involves the assessment of environmental, social and governance factors in the investment process. We integrate relevant ESG factors into our investment decisions and expect our underlying investment managers to do the same. By doing so, we aim to create long-term value, and/or avoid undue risks.

Where investment mandates are delegated to underlying investment managers, we integrate ESG through the selection, appointment, monitoring and review of the underlying investment managers. Our domestic cash and fixed interest team integrates ESG factors throughout the investment lifecycle including research, portfolio construction and security selection and portfolio monitoring.

Example of key ESG factors that can be considered:

Climate change.

Climate change presents investment risks and opportunities. We aim to understand and manage the investment risks and opportunities arising from climate change, including by conducting climate scenario analysis.

Through our Climate Transition Plan, included in our Climate Statements, we have further developed our approach to climate change, including how we manage climate-related risks and opportunities and support the goals of the Paris Agreement.

We have an ambition to reach net zero portfolio emissions by 2050 and to increase the proportion invested in entities achieving net zero or aligned, or aligning, to a net zero pathway. We intend to report on progress against our Climate Transition Plan yearly.

Climate statements.

Our approach to sustainable investment helps us manage climate-related risks and opportunities. In the latest climate statements for each of our managed funds we share where we are on our journey towards a low-emissions, climate-resilient future for Aotearoa New Zealand - the targets we’ve set and the metrics we use to measure our progress.

Note: BTNZ has relied on the exemption set out in clause 11 of the Financial Markets Conduct (Climate Reporting Entities in Liquidation, Wind-up, or External Administration) Exemption Notice 2024 for the Income Strategies Trust, as the fund was closed on 28 February 2025. Relying on this exemption means that the Westpac Active Series Climate Statement for the reporting period ended 31 March 2025 does not contain information in relation to the Income Strategies Trust.

Stewardship.

We define stewardship as the responsible management of our customers’ investments to create and preserve long-term value. This includes using our influence over current or potential underlying investment managers, companies and other issuers, policy makers, service providers and other stakeholders – sometimes collaboratively.

Active stewardship entails exercising voting rights and engaging with companies and other issuers either directly through our internal team or via our underlying investment managers, as well as collaborating with the industry.

We believe stewardship helps promote higher standards of corporate governance, which contributes to long-term value creation and preservation, in doing so, reducing risk and increasing long-term returns to our customers. For this reason, stewardship is considered a core part of how we and our underlying investment managers integrate important ESG matters into our investment decision-making processes.

Sustainable themes.

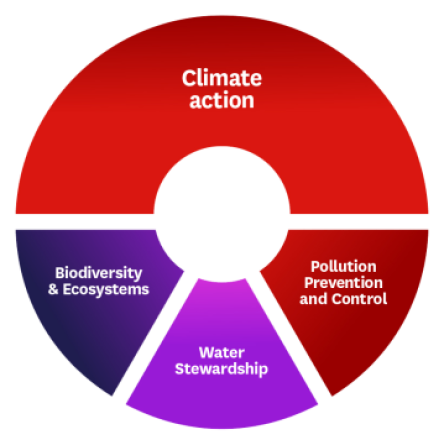

We believe climate change, ecosystem destruction, and biodiversity loss are some of the most significant issues to affect our environment – and our economy. We aim to pursue opportunities and contribute to positive environmental outcomes, and are working towards investing more in the following sustainable themes:

For more information on our sustainable investment themes, see our full Sustainable Investment Policy.

We are proud members of, or a signatory to:

Things you should know.

1 The Responsible Investment Certification Program provides general advice only and does not take into account any person’s objectives, financial situation, or needs. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Because of this, you should consider your own objectives, financial situation and needs and also consider the terms of any product disclosure document before making an investment decision. Certifications are current for 24 months and subject to change at any time.

2 Where we refer to companies within this pillar, we refer to both shares and debt issued by companies.

3 As determined by the Global Industry Classification Standard (GICS).

4 For the avoidance of doubt, this exclusion does not apply to the extraction of coking coal, which is used in steel production.

5 The Net Zero Asset Managers initiative has suspended its activities as it undertakes a review of the initiative.

All our managed funds, including the Westpac KiwiSaver Scheme, Westpac Active Series and Westpac Retirement Plan are managed under our Sustainable Investment Policy.

BT Funds Management (NZ) Limited (BTNZ) is the scheme provider and issuer, and Westpac New Zealand Limited is a distributor of, the managed investment schemes referred to above, including the Westpac KiwiSaver Scheme. You can get a copy of any applicable Product Disclosure Statement for these investments from any Westpac branch in New Zealand or download here:

The information above is subject to changes to government policy and law, and changes to the applicable managed investment scheme, from time to time. Investments do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies. They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BTNZ (as manager), any member of the Westpac group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees any scheme's performance, returns or repayment of capital.