Merchant service fees.

Every business is unique, so we offer pricing options to suit your business needs.

What are merchant service fees?

Merchant service fees (MSF) are charged for certain types of card transactions processed through your merchant facility. A percentage of each sale is paid to Westpac for the processing of your monthly transactions.

Your merchant service fee will vary based on several factors, including what type of business you have, how many transactions you process, and what card types you accept.

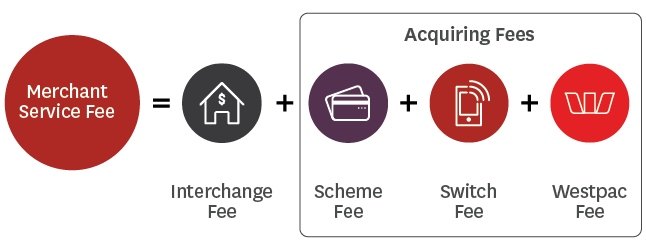

What makes up a merchant service fee?

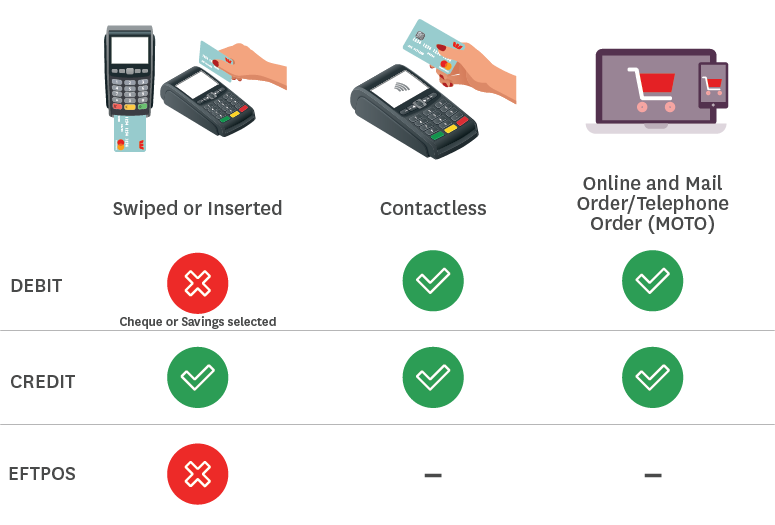

Compare payment types.

Which payment types and methods of payment incur merchant service fees?

Pricing options.

Blended

Simplified pricing that provides you with a set fee per transaction type.

We have two types of transactions – ‘in-store’ (card present), or ‘card not present’. These rates are shown in the table below.

For in-store transactions, we offer one fee for credit cards (both domestic and international issued), and one fee for contactless debit cards. There is no fee for debit cards where the card is inserted or swiped.

For card not present transactions, one fee also applies, regardless of card type.

|

|

Card present |

Card not present |

|

|

Card type |

Contactless |

Insert/swipe |

|

|

NZ debit cards |

0.69% |

- |

1.99% |

|

Credit Cards1 |

1.59% |

1.59% |

1.99% |

1 Includes international issued cards.

Transaction fees are charged as a percentage of net sales (i.e. sales less refunds) depending on the card type.

Example of a blended pricing plan:

I have a small business. A simple pricing plan that’s easy to understand provides me more certainty in what my costs are, so I can plan and include these costs in my budget.

Interchange Plus (unbundled)

You'll be charged two separate rates on each transaction. A rate for the interchange (issuer) charges, and a separate rate for acquiring fees.

Example of an Interchange Plus (unbundled) pricing plan:

I have a mature business operating in 20 locations throughout the country, I like the transparency and insight I get through an Interchange Plus fee, such as the card types and my customers' preferred method of payment.

Domestic interchange fees.

Interchange is the fee that the cardholder’s bank (the ‘issuer’) charges for the provision of card payment services – this can include cardholder services, reward schemes, processing costs, and fraud protection. The fees are charged to the financial institution that processes card transactions on behalf of a merchant (the ‘acquirer’). These are variable fees set by the card schemes and are outlined below.

Westpac Domestic Card Issuing Interchange Fees.

The following fees are current as of 12 November 2022 and are subject to change by Westpac without notice. All fees outlined in the tables below are a percentage of the transaction amount unless a dollar amount is specified.

Mastercard credit card transactions

|

Interchange category name |

Rate |

|

Charities |

0.00% |

|

Strategic Merchants 1 |

0.50% |

|

Strategic Merchants 2 |

0.60% |

|

Strategic Merchants 3 |

0.70% |

|

Strategic Merchants 4 |

0.80% |

|

Strategic Merchants 5 |

0.80% |

|

Tokenised contactless |

0.50% |

|

Contactless (excluding commercial cards) |

0.50% |

|

Government and Utilities |

0.70% |

|

Petroleum |

0.60% |

|

Education and Learning |

0.80% |

|

Recurring Payments - Tokenised |

0.80% |

|

Recurring Payments - Others |

0.80% |

|

Commercial |

2.10% |

|

Tokenised Online |

0.80% |

|

Consumer Super Premium - Card Present |

0.80% |

|

Consumer Premium - Card Present |

0.80% |

|

Consumer Standard - Card Present |

0.80% |

|

Consumer Super Premium - Card Not Present |

0.80% |

|

Consumer Premium - Card Not Present |

0.80% |

|

Consumer Standard - Card Not Present |

0.80% |

Mastercard debit card transactions

|

Interchange category name |

Rate |

|

Charities |

0.00% |

|

Contactless Micropayment (less or equal to $15) |

0.20% |

|

Contactless Strategic Merchants 1 |

NZD 0.04 |

|

Contactless Strategic Merchants 2 |

NZD 0.05 |

|

Tokenised Contactless |

0.20% |

|

Contactless |

0.20% |

|

Contact - Card Present |

0.00% |

|

Strategic Merchants 1 |

0.30% |

|

Strategic Merchants 2 |

0.35% |

|

Strategic Merchants 3 |

0.40% |

|

Strategic Merchants 4 |

0.60% |

|

Strategic Merchants 5 |

0.60% |

|

Government and Utilities |

0.50% |

|

Petroleum |

0.50% |

|

Recurring Payments - Tokenised |

0.60% |

|

Recurring Payments - Others |

0.60% |

|

Tokenised Online |

0.60% |

|

Consumer - Card Not Present |

0.60% |

Mastercard prepaid card transactions

|

Interchange category name |

Rate |

|

Contactless Micropayment (less or equal to $15) |

0.20% |

|

Strategic Merchants 1 |

0.40% |

|

Strategic Merchants 2 |

0.40% |

|

Strategic Merchants 3 |

0.40% |

|

Strategic Merchants 4 |

0.90% |

|

Strategic Merchants 5 |

1.10% |

|

Tokenised Contactless |

0.20% |

|

Commercial |

1.50% |

|

Contactless |

0.20% |

|

Government and Utilities |

0.50% |

|

Petroleum |

0.50% |

|

Recurring Payments - Tokenised |

0.70% |

|

Recurring Payments - Others |

0.70% |

|

Tokenised Online |

1.00% |

|

Consumer - Card Present |

0.50% |

|

Consumer - Card Not Present |

1.25% |

Things you need to know.

The information on this page is a guide only. Participation in a Westpac Merchant Services Agreement is subject to Westpac's approval. Westpac's current credit criteria apply. Terms, fees and charges apply to Westpac products and services.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.