Business Revolve Account.

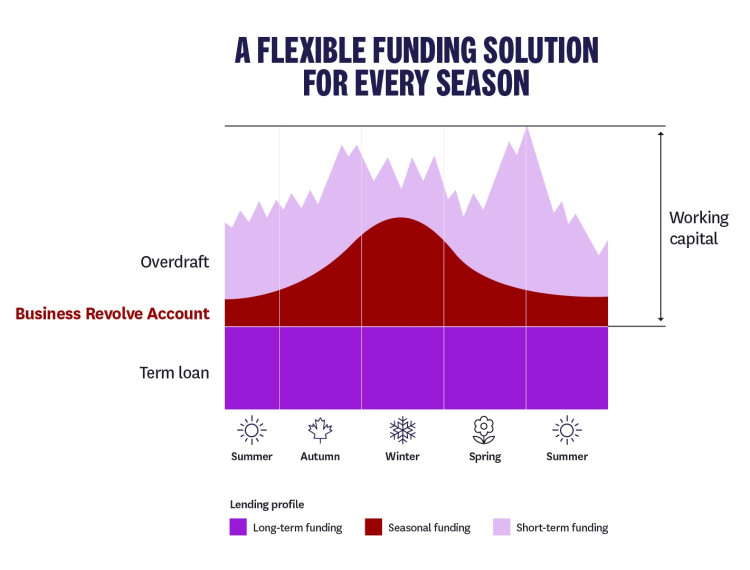

Flexible on-call credit to support your cashflow — in busy seasons and quieter ones.

Understanding the Business Revolve Account.

Running a business or farm means your cashflow can go up and down. The Business Revolve Account gives you flexible access to funds when you need them — and helps reduce interest when you don’t.

Whether you’re facing unexpected costs, gearing up for a new season, or just want breathing room in your cashflow, the Business Revolve Account could be a smart option to support your day-to-day needs.

Why choose the Business Revolve Account?

- Support your cashflow through seasonal changes.

Access to funds whether you're in a busy period or a quieter one. - Only pay interest when you need to.

Use your own funds to reduce interest and redraw when needed. - Access funds when you need them.

Redraw money at any time (within your limit) to cover costs or take on new opportunities.

How it works.

The Business Revolve Account is a flexible line of credit linked to your everyday banking.

You can access and repay funds as needed, within your approved limit, without needing to submit a new application each time.

Features.

Variable interest rate

You pay a floating interest rate that may increase or decrease in line with the market.

Flexible repayments

You can repay debt and redraw funds quickly, when you need.

Available 24/7

Access your line of credit online, anywhere, anytime in digital banking.

Things you should know.

Depending on the amount of your Business Revolve Account, you might need to provide some security, such as residential property, commercial property or business assets.

Terms, conditions, fees and charges apply to Westpac products and services. See the Business Transaction and Service Fees brochure for details.

Lending criteria and eligibility requirements apply.

Business Lending products are only available for business and/or investment purposes and not for personal, domestic or household purposes.