The right tax rate.

Find out whether you have the correct PIR and how to update it.

More about PIR (Prescribed Investor Rate).

All funds or schemes managed by BT Funds Management (NZ) Limited are Portfolio Investment Entities (PIEs) for tax purposes. This means that we'll:

- calculate the amount of taxable income (or loss) as well as any tax credits or other amounts attributable to you from your investment; and

- pay tax on the taxable income attributed to you at your notified PIR.

You'll need to provide both your IRD number and your PIR, otherwise the highest PIR will apply.

Your PIR will be one of the following:

| 10.5% |

If you're a New Zealand tax resident and in either one of the last two income years:

|

| 17.5% |

If you're a New Zealand tax resident and you don't qualify for the 10.5% rate but in either of the last two income years:

|

| 28% | If you don't meet the requirements for the 10.5% or 17.5% rates (or you fail to notify a PIR), or you're not a New Zealand tax resident. |

Income years generally run from 1 April in any year to 31 March the following year.

Non-New Zealand income counts when calculating your PIR

When working out your PIR, you must include non-New Zealand sourced income in calculating your taxable income for any particular income year - even if you weren't a tax resident in New Zealand when that income was earned. This is especially important for new residents to consider. In some cases, new residents can elect out of this situation. Simply visit Inland Revenue's website www.ird.govt.nz to find out more.

It's important to let us know your correct IRD number and PIR

From 1 April 2020, Inland Revenue will assess your PIR based on the information they have on your income. If they think your PIR is incorrect, they will provide us with an updated PIR and we must update it for you. However, you can subsequently advise us of a new PIR if you think Inland Revenue has given us an incorrect PIR.

From the 2021 tax year end onwards, Inland Revenue will automatically assess your PIE tax liability if your PIR has been incorrect at any time during the tax year. If your PIR was too high, you may receive a refund for overpaid PIE tax from Inland Revenue. However, if your PIR was too low, you will be required to pay any PIE tax shortfall using the correct PIR to Inland Revenue.

If you invested prior to 1 April 2018 and have not provided your IRD number, then all taxable income attributed to you will be taxed at 28%. Finally, it is important to let us know if your PIR changes to ensure you're not under or over-taxed.

It's easy to update your PIR in Westpac One®

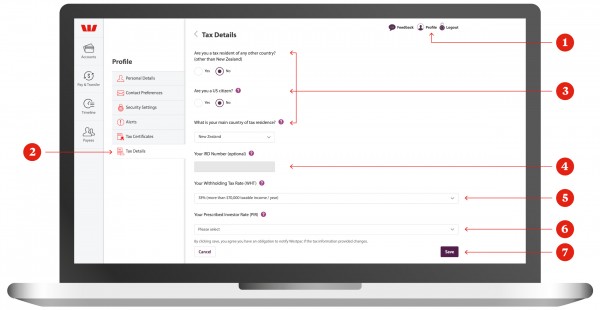

You can update your PIR through Westpac One online banking at any time. If we don't already have your IRD number, you'll also need to add this. To update your PIR, just login to Westpac One and follow these steps:

- Select Profile

- Select Tax Details

- Answer the tax residency questions

- Enter your IRD Number

- Select your Withholding Tax Rate

- Select your PIR

- Hit Save

Other ways you can update your PIR include:

- Visit your nearest Westpac branch

- Contact us at kiwisaverhelp@westpac.co.nz or on 0508 972 254 (+64 9 375 9978 )

Things you should know.

The information in this webpage is intended for general tax information and illustrative purposes only, it does not constitute tax advice, and should not be relied upon for tax purposes.

Taxation legislation, its interpretation and the rates and bases of taxation may change. You should seek independent professional advice on the tax implications of your investments based on your particular circumstances.

Westpac, BT Funds Management (NZ) Limited and Trustees Executors Limited do not accept any responsibility for the tax consequences of your investment in a PIE.