Westpac New Zealand (Westpac NZ)[i] says a solid full-year financial result puts it in a strong position to support customers, amid an uncertain economic environment.

Westpac NZ’s cash earnings[ii] were up 15% for the 12 months ended 30 September 2022, compared with the same period last year.

Excluding the sale of Westpac Life[iii] and other notable items, there was an underlying decrease in cash earnings of 2%.

Chief Executive Catherine McGrath said Westpac NZ had good positive momentum.

“We’ve sought to turn more Kiwis into customers through great service and competitive offers. This has translated into good growth in mortgage and business lending market share in the past six months.”

Customer focus

Ms McGrath said the result equips Westpac NZ to continue supporting customers.

“After a year of market volatility and rising living costs, many New Zealanders will be feeling uncertain about the future. We want our customers to know our bankers are here to offer help and solutions.”

She said Westpac NZ was stepping up its support for customers through a range of initiatives, including:

- Opening branches an additional 370 hours a week across the country.

- Increasing contact centre staffing to reduce call wait times and opening a new regional contact centre in Hamilton

- Increasing the number of specialist bankers for customers with complex needs requiring extra care

- Proactively reaching out to customers at risk of hardship, or who are about to experience large mortgage rates increases, to offer assistance with options.

“In May we pledged to open our branches 300 extra hours per week across the country to be there to talk to our customers, and in fact we’ve now gone beyond that to be open an extra 370 hours.

“We have also expanded our ‘Extra Care’ team, which focuses on customers in vulnerable circumstances – for example those with a serious illness.

“We’ve also recruited more people into our contact centres, meaning phones are being answered faster. In fact, just today we’re opening a brand new contact centre in Hamilton, with roles that we hope will provide a pathway into a banking career for people in Waikato.

“Another area of focus is cutting costs for customers. We recently removed nine lending and overdraft fees[iv], and have also removed all fees from our low-interest credit card[v].

“With the cost of living increasing, one great way to immediately lower power bills is by making homes more energy efficient. Insulated houses are cheaper to heat, while heatpumps warm up homes more efficiently than electric heaters.

“Our expanded Westpac Warm Up loans[vi] allow home loan customers to fund these types of improvements by borrowing up to $40,000 over five years at zero percent interest. We aim to reach $100m in interest free lending on these loans and are already at $41m.

“Overall, households and businesses are managing reasonably well, but we know there are some customers doing it tough. We’re here to work with those households and businesses and I’d encourage anyone who needs help to get in touch.”

Economic outlook

Ms McGrath said despite the market volatility and a worsening global economic outlook, the fundamentals of the economy remained strong and New Zealand was well-positioned relative to other countries.

“Commodity prices are holding firm, exporters are being assisted by the subdued New Zealand dollar, and hospitality businesses will be pleased tourists are beginning to return.

“Inflation remains a concern, however our economists think that the rate of increase has peaked, and the accumulated effect of higher interest rates will gradually bring it down over the next couple of years.”

Sustainable lending

Westpac NZ was committed to supporting customers to curb emissions, Ms McGrath said.

“In addition to recently revamping our Westpac Warm Up loan, we launched a personal loan[vii] that enables customers to buy an electric vehicle, electric bike or scooter at a discounted interest rate.

“During the reporting period, we also signed $943m worth of sustainability-linked loans with organisations that included Christchurch International Airport, T&G Global and Auckland Council and we are piloting a new Sustainable Agribusiness Loan with a small group of farmers.

“We know that reducing emissions is particularly challenging for the agriculture sector. We’re working with Lincoln University to provide practical, high quality, impartial information resources for our farming customers to support them with decisions around climate adaptation and emissions reductions.”

Westpac Group, which includes Westpac NZ, has signed up to the UN-convened Net-Zero Banking Alliance, confirming a commitment to align our lending portfolio to net-zero by 2050, and set 2030 financed emissions lending targets for five sectors.

Key financials

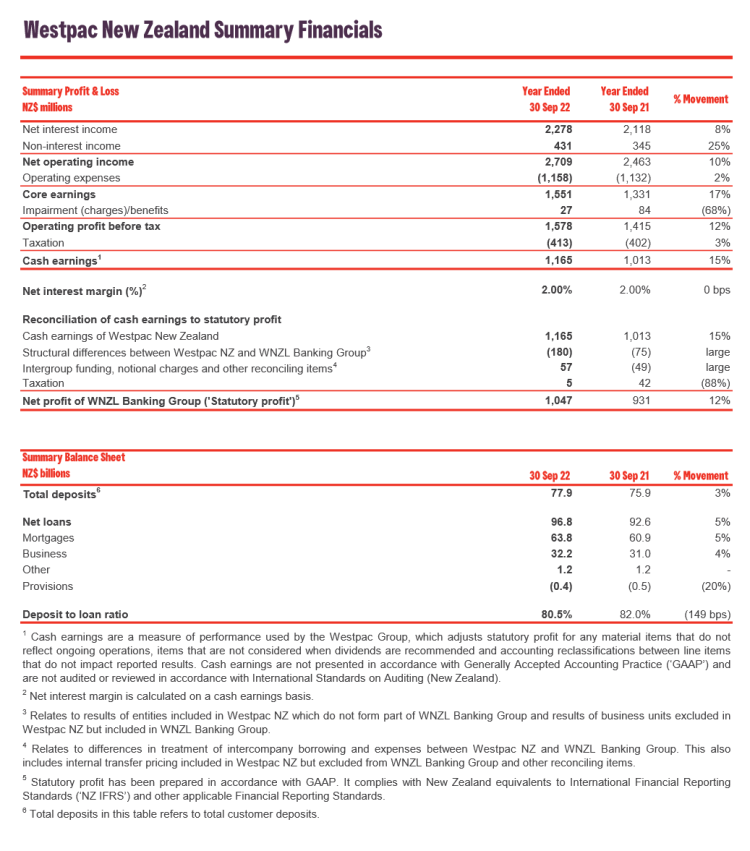

(All comparisons are for the 12 months ended 30 September 2022 versus the same period last year)

- Cash earnings of $1,165m, up 15%.

- Cash earnings (excl notable items) of $1,041m, down 2%.

- Core earnings of $1,551m, up 17%.

- Net operating income of $2,709m, up 10%.

- Operating expenses of $1,158m, up 2%.

- Net impairment benefit of $27m, compared with an impairment benefit of $84m in the previous comparative period.

- Net interest margin 2.00%, unchanged.

Ms McGrath said the sale of Westpac Life had added a one-off gain of $126m to the financial result.

Home lending grew by 5%, business lending by 4%, and deposits by 3%, compared to the same period last year.

“We’ve grown our market share in the second half of the year across home and business lending, giving us strong momentum as we go into the new financial year.

“While the rise in interest rates has coincided with a retreat in house prices, recent home buyers who have bought for the long term shouldn’t be worried about the current value of their property.”

Funds under management in the Westpac KiwiSaver Scheme[viii] decreased 3% year-on-year, to $8.9 billion as at 30 September 2022, as a result of volatility in financial markets.

“Beyond the market movement, this has been a big year for the KiwiSaver team. We’re delighted that the manager of the Westpac KiwiSaver Scheme, BT Funds Management (NZ) Limited, has been named a Responsible Investment Leader for 2022 by the Responsible Investment Association Australasia. We’ve also had 37,000 new KiwiSaver members transfer to our new Default Balanced Fund, following our reappointment as one of six default providers,” said Ms McGrath.

Together Greater

Ms McGrath said Westpac NZ was committed to making banking more financially inclusive for a wider group of customers across areas such as home ownership and access to bank accounts.

Westpac NZ had become the first major bank to sign up to the Secure Home housing programme run by the not-for-profit Queenstown Lakes Community Housing Trust. The scheme allows Queenstown Lakes residents to borrow money to purchase a house on land owned by the Trust.

“We’re also the only major bank to support both Kāinga Ora’s First Home Partner and First Home Loan schemes. Both programmes have seen increasing interest from buyers this year, with 260 First Home Partner loans pre-approved in the reporting period.

“We also want to improve access to basic bank accounts and are working with various groups on this issue. For example, this year we expanded a programme with the Department of Corrections that enables prisoners nearing release to get a Westpac NZ account to help them overcome a barrier to effective resettlement in the community.”

[i] Westpac New Zealand is a segment of Westpac Banking Corporation (WBC). Westpac New Zealand includes, but is not limited to, Westpac New Zealand Limited, BT Funds Management (NZ) Limited and WBC (New Zealand branch). Westpac Life-NZ- Limited was included in Westpac New Zealand until 28 February 2022 when the completion of the sale by Westpac Financial Services Group-NZ- Limited (a subsidiary of Westpac Banking Corporation) to Fidelity Life Assurance Company Limited occurred. The financial results of Westpac New Zealand Limited will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac New Zealand Summary Financials section of this media release.

[ii] Cash earnings are a measure of performance used by the Westpac Group, which adjusts statutory profit for any material items that do not reflect ongoing operations, items that are not considered when dividends are recommended and accounting reclassifications between line items that do not impact reported results. Cash earnings are not presented in accordance with Generally Accepted Accounting Practice (‘GAAP’) and are not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

[iii] https://www.westpac.co.nz/about-us/media/westpac-completes-sale-of-new-zealand-life-insurance-business-to-fidelity-life/

[iv] https://www.westpac.co.nz/about-us/media/westpac-nz-removes-nine-lending-and-overdraft-fees/

[v] https://www.westpac.co.nz/about-us/media/westpac-nz-offers-fee-free-credit-card/

[vi] https://www.westpac.co.nz/about-us/media/westpac-nz-announces-package-of-sustainability-initiatives/

[vii] https://www.westpac.co.nz/about-us/media/westpac-nz-launches-personal-loan-for-evs-and-e-bikes/

[viii] BT Funds Management (NZ) Limited is the scheme provider and issuer and Westpac New Zealand Limited is a distributor of the Westpac KiwiSaver Scheme. A copy of the product disclosure statement for the Westpac KiwiSaver Scheme is available from any Westpac branch in New Zealand or by visiting www.westpac.co.nz