Westpac New Zealand (Westpac NZ)[i] has delivered a strong full-year financial result, driven by a focus on improving the banking experience for customers.

Cash earnings[ii] for the 12 months ended 30 September 2018 were up 5% on the same period last year. The bank grew deposits and lending, against the backdrop of a strong economy and changing banking environment.

Low levels of impairment expenses reflected the net impact of stable asset quality and recoveries across the dairy portfolio.

Westpac NZ Chief Executive David McLean said a three-year focus on business transformation was delivering benefits for the bank, its customers and communities.

“This project involved investing money into critical parts of the business to simplify the banking experience, streamline dated processes, and improve services and fees for our customers.”

Putting customers first

Mr McLean said Westpac NZ remained focused on delivering great outcomes for its customers.

“Our mission is to help our customers financially, to grow a better New Zealand. We are supporting our customers to save and invest, with deposit growth again outpacing lending growth over the last 12 months and customers using low interest rates to repay their mortgages faster.

“We have invested significantly over the past three years to enhance services and outcomes for customers and will continue to do so.

“We’ve also been busy analysing customer data and proactively contacting individual customers through our ‘Value Me’ programme to check if their bank account or Westpac KiwiSaver Scheme[iii] fund best meets their needs. We’ve contacted more than 470,000 customers during the past year.”

The range of payment options available to customers continued to grow, with the introduction of contactless payments on Android phones through Westpac Pay. Another product, Get Paid, enabled business owners to take card payments anytime and anywhere using their phone.

Mr McLean said 13 banking fees or charges had been reduced or removed in the past year, on top of 11 fees or charges in the previous year. Westpac NZ also removed individual sales targets for frontline branch and contact centre staff, with incentives strongly focused on customer service and feedback.

“This is another step in ensuring a consistent focus on good customer service and outcomes in everything we do,” said Mr McLean.

Changing banking environment

Mr McLean noted the report on conduct and culture by the Financial Markets Authority and Reserve Bank of New Zealand would be released later today.

“We’ve been working closely with the regulators. We are firmly focused on putting customers first and delivering positive customer outcomes. We will be working through any issues regulators identify to ensure we retain the trust of our customers and other stakeholders.

“Where any issues are identified we are committed to fixing those quickly.”

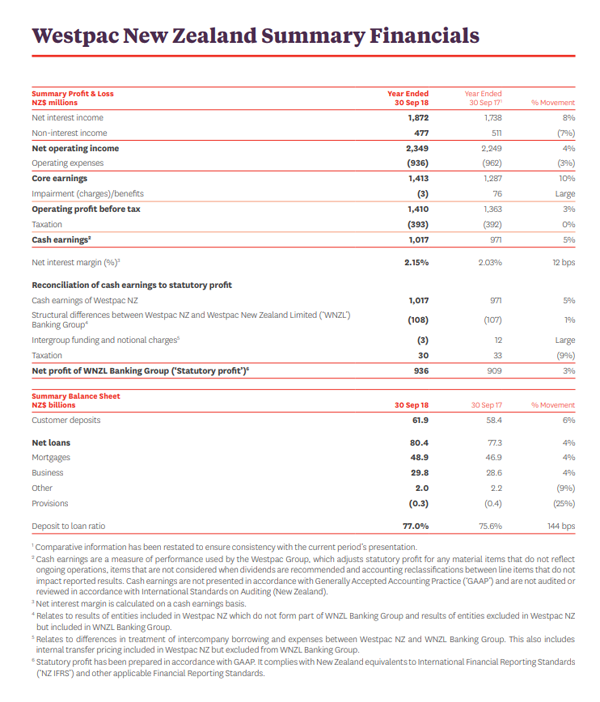

Key Financials

(All comparisons are for the 12-month period, ended 30 September 2018 versus the same period last year).

- Cash earnings of $1,017m, up 5%

- Net operating income of $2,349m, up 4%

- Operating expenses of $936m, down 3%

- Impairment expenses of $3m, compared with net impairment benefit of $76m in the prior comparative period

- Net interest margin 2.15%, up 12 basis points

Home loans and business lending both grew 4% over the past year, supported by customer deposit[iv] growth of 6% in a competitive market.

“Generally favourable conditions on the farm helped lift our agri lending by 5%, while deposits from farmers increased 14%. This reflects a good turn around in the dairy sector from three years ago and a broadly healthy agricultural sector,” said Mr McLean.

Funds in the Westpac KiwiSaver Scheme increased by 17%, from $5.2 billion to $6.1 billion as at 30 September 2018. The number of Westpac KiwiSaver Scheme accounts increased by 3,584 and the average balance increased 16% to $15,300. The Westpac KiwiSaver Scheme retained its SuperRatings[v] Platinum rating for a fifth consecutive year.

Supporting New Zealand

During the year to September 30 2018, Westpac NZ contributed to the New Zealand economy by paying:

- $445 million in tax

- $484 million in salaries and wages to staff and contractors

- $613 million to suppliers

- $8 million in sponsorships and contributions to the community

Westpac NZ launched two projects during the year designed to make housing more accessible for New Zealanders.

- A pilot programme, started in May, is pioneering a way to make it easier for people to access finance to build a prefabricated home. Prefab homes are cheaper and faster to build, potentially helping the affordability and supply of housing.

- Westpac NZ has also worked with Bay of Plenty iwi, Ngā Potiki, to establish a shared equity scheme that will help 40 iwi members realise their dreams of home ownership.

“We believe shared equity is an innovative solution that has the potential to help more New Zealanders into homes they would otherwise be unable to afford,” Mr McLean said.

Westpac NZ was proud to return to a new location in the heart of central Christchurch in May. The new office and flagship branch at The Terrace holds a 5 Green Star rating.

Westpac NZ also continued to engage on some of the big issues facing New Zealand. Mr McLean said Westpac NZ had renewed calls for faster action on climate change after commissioning a report from EY and Vivid Economics that revealed strong economic benefits in faster action.

“The report found the economy could be $30 billion better off by 2050 if early action is taken to meet New Zealand’s Paris Agreement commitments. Our view is we need to get moving now.”

During the year Westpac NZ became a founding member of the Climate Leaders Coalition and welcomed 68 new electric or hybrid cars as part of its commitment to convert 30% of its fleet to electric power by the end of 2019.

The bank also released a ‘Diversity Dividend’ report that revealed just 29% of management positions in New Zealand businesses are held by women, and spelt out the financial and social case for change. At Westpac NZ, 52.2% of management positions are currently held by women on internal measures.

During the year, Westpac NZ has also:

- Increased the level of sustainable business lending to climate change solutions from $1.5 billion (at FY17) to $1.6 billion.

- Provided Managing Your Money workshops to more than 5,200 New Zealanders. • Won two White Camellia awards, recognising its commitment to promoting gender equality across the organisation and broader community.

- Become the first New Zealand organisation to receive the DVFREE Tick from domestic abuse charity Shine – recognising the organisation has a comprehensive programme to tackle domestic violence.

About Westpac NZ

Westpac NZ has been serving New Zealanders since 1861 and is today one of the country’s largest full service banks with more than 1.3 million customers.

We provide a full range of retail and commercial financial services including home and business lending, funds management, life insurance and treasury services.

Westpac NZ is committed to improving the social, environmental and economic wellbeing of all New Zealanders. Our purpose is to help our customers financially to grow a better New Zealand.

[i] Westpac New Zealand is a division of Westpac Banking Corporation, and is not the same as Westpac New Zealand Limited. The financial results of Westpac New Zealand Limited will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac New Zealand Summary Financials section of this media release.

[ii] Cash earnings are a measure of performance used by the Westpac Group, which adjusts statutory profit for any material items that do not reflect ongoing operations, items that are not considered when dividends are recommended and accounting reclassifications between line items that do not impact reported results. Cash earnings are not presented in accordance with Generally Accepted Accounting Practice (‘GAAP’) and are not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

[iii] BT Funds Management (NZ) Limited is the scheme provider, and Westpac New Zealand Limited is the distributor, of the Westpac KiwiSaver Scheme. A copy of the Product Disclosure Statement for the Westpac KiwiSaver Scheme is available from any branch or online at westpac.co.nz.

[iv] Deposits are equal to deposits at amortised cost as disclosed in the Westpac New Zealand Limited Disclosure Statement.

[v] Westpac KiwiSaver Scheme received the Platinum rating from SuperRatings in 2015, 2016, 2017 and 2018, and has recently received it again for 2019. SuperRatings does not issue, sell, guarantee or underwrite this product. See www.superratings.com.au for details of its ratings criteria.