Westpac New Zealand (Westpac NZ)[i] has reported a solid half-year result, with good momentum in a competitive market.

Cash earnings[ii] for the six months ended 31 March 2018, was up 4% on the same period last year. The result was driven by strong core earnings, partly offset by loan impairments returning to more normal levels following previous write-backs from recoveries in the Agri sector in 2017.

Westpac NZ Chief Executive David McLean said the result reflected a strong underlying economy and targeted growth in key sectors, supported by quality lending.

“This is a good result across a range of business areas, despite a slowing housing market, a competitive deposit environment, and impairments moving back to more normal levels. These results have been supported by strong fundamentals in the economy,” Mr McLean said.

Customer-focussed

Mr McLean said Westpac NZ remained focused on delivering a great experience for its customers, with a continued emphasis on transforming the business to improve customer service.

“Our mission is to help our customers financially, so we can grow a better New Zealand. We have continued to invest in our business over the past six months to enhance our services to customers.

“We are supporting our customers to save and invest, with customer deposit growth outpacing lending growth over the past 12 months,” Mr McLean added.

Our ‘Value Me’ programme, which proactively encourages customers to check if their transactional account, savings account or Westpac KiwiSaver Scheme fund suits their needs, has been a particular success with customers.

“More than 2,000 customers have actively changed their Westpac KiwiSaver Scheme fund to one that better suited their needs.

“Fees are another area where we have continued to listen to customer feedback, and we were one of the first major banks in New Zealand to announce that we were removing fees to Westpac customers using their EFTPOS or debit cards at other banks’ ATMs. We will continue to review our fees on an ongoing basis,” Mr McLean said.

“By putting our customers’ needs at the heart of banking, we have also seen a 30% increase in registered users of our CashNav app[iii], enabling customers to better manage their money.

“Customers want quick, easy and secure access to banking from the comfort of their home or when on the move, and our banking apps are proving popular. We’ve seen an 11% increase in customers using Quick Access[iv] and a 12% increase in mobile log-ins to make payments or transfer money,” he said.

Mr McLean said Westpac NZ is absolutely committed to operating in a way that builds confidence and trust with our customers.

“Westpac welcomes the review announced last week by the Financial Markets Authority and Reserve Bank of New Zealand, and will cooperate fully in order to show the differences between the New Zealand and Australian banking environments.

“We are confident in our systems and processes and are committed to continuous improvement to ensure we operate at best practice.”

Key Financials

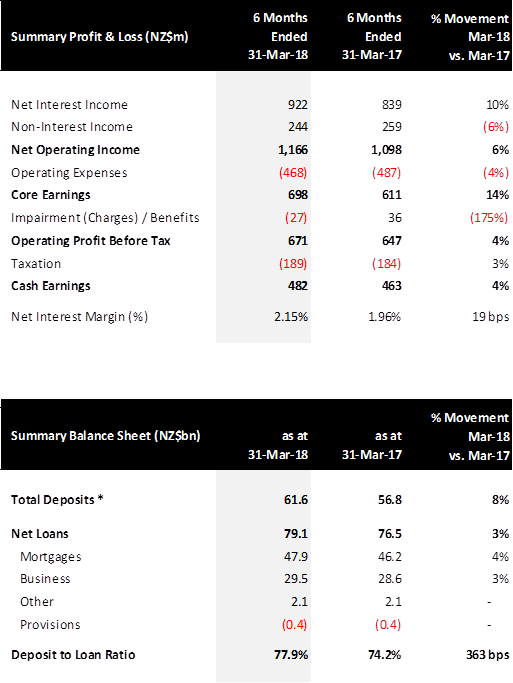

(All comparisons are for the six-month period, ended 31 March 2018 versus the same period last year).

- Cash Earnings of $482m, up 4%

- Core Earnings of $698m, up 14%

- Net Operating Income of $1,166m, up 6%

- Operating expenses of $468m, down 4%, reflecting cost management and productivity gains

- Impairment expenses of $27m, compared with net impairment write-backs of $36m in the prior comparative period

- Customer deposits[v] up 8%, with total net lending up 3%

- Funds under management in Westpac KiwiSaver Scheme increased 19% to $5.56b

- Housing lending of $48b, up 4%

- Business lending of $30b, up 3%

- Net interest margin 2.15%, up 19 basis points

Funds under management in the Westpac KiwiSaver Scheme[vi] increased by 19% ($894m), from $4.67b to $5.56b, for the full year ended 31 March 2018. During the same period, the number of Westpac KiwiSaver Scheme accounts increased by 1.7% (6,448), and the average balance increased from $12k to $14k, up 17%.

“We believe KiwiSaver is one of the best ways our customers can save for retirement. The Westpac KiwiSaver Scheme continues to provide members excellent value. We have received the Platinum rating from independent research house SuperRatings[vii] for four consecutive years.

“SuperRatings describes the Westpac KiwiSaver Scheme as a ‘best value for money[viii]’ KiwiSaver scheme and also rated it as ‘excellent’ for fees and charges for medium and large accounts,” Mr McLean said.

The cooling housing market presented an opportunity for first-home buyers with an 11.7% increase in Westpac KiwiSaver Scheme members withdrawing funds for a first home over the past six months to 31 March 2018.

“In the dairy sector, it’s been encouraging to see the milk price and dividend pay-out stabilise and farmers continue to reduce debt, restoring their finances after the pay-out slump,” he said.

Supporting New Zealand

Westpac NZ continues to support New Zealand in a range of ways beyond our core business, including recently announcing further steps to help tackle climate change.

“The finance sector has a major role to play in helping New Zealanders transition to a low carbon economy. We’ve set a target to lift our lending to green businesses, which are providing solutions to climate change, from $1.5 billion to $2 billion by 2020,” Mr McLean said.

Since 1 October 2017, the bank has increased that figure by nearly $200 million to $1.7 billion, with most new lending in the renewable energy sector. Other results include:

- Reducing emissions[ix] by 6% compared to the same period last year.

- Running free Managing Your Money workshops for 1,340 people in the past six months.

- Continuing support for the Middlemore Foundation’s Mana-ā-Riki programme, a pilot focused on improving health and educational outcomes in South Auckland. In 18 months, it delivered over 1,000 Chromebooks to six pilot schools, conducted over 9,600 throat swabs and treated 1,253 cases of Group A Streptococcus (a precursor for rheumatic fever).

Westpac New Zealand - Summary Financials

*Total deposits in this table refers to total customer deposits

About Westpac New Zealand (NZ)

Westpac NZ has been serving New Zealanders since 1861 and is today one of the country’s largest full service banks with more than 1.3 million customers.

We provide a full range of retail and commercial financial services including home and business lending, funds management, life insurance and treasury services.

In addition to salaries to 4,295 staff and contractors, and tax paid, in the last six months to 31 March 2018. We also contributed $327 million to the economy via payments to 1,753 suppliers.

Westpac NZ is committed to improving the social, environmental and economic wellbeing of all New Zealanders. One of the biggest impacts Westpac NZ can have is by using our financial expertise to help customers and New Zealanders manage their money.

More than 33,000 New Zealanders have attended our Managing Your Money workshops since 2012, and we have supported those in hardship through our six-week Money Skills course. Our online budgeting tools and videos have been accessed by more than 112,000 people (also since 2012), and our CashNav app helps our customers track their spending. By helping people financially, we can grow a better New Zealand.

Footnotes

[i] Westpac New Zealand is a division of Westpac Banking Corporation, and is not the same as Westpac New Zealand Limited. The financial results of Westpac New Zealand Limited will be available in the Westpac New Zealand Disclosure Statement, and a reconciliation between the two results is provided in conjunction with the publishing of the Westpac New Zealand Disclosure Statement.

[ii] Cash earnings are a measure of performance used by the Westpac Group, which adjusts statutory profit for any material items that do not reflect ongoing operations, items that are not considered when dividends are recommended and accounting reclassifications between line items that do not impact reported results. Cash earnings is not a measure of cash flow or net profit determined on a cash accounting basis, as it includes non-cash items reflected in statutory profit determined in accordance with IFRS. A reconciliation between Westpac New Zealand’s cash earnings result and Westpac New Zealand Limited’s statutory profit result is provided in conjunction with the publishing of the Westpac New Zealand Limited Disclosure Statement.

[iii] For the six-month period ended March 2018 compared with the same period in 2017.

[iv] The Westpac One smartphone app has a special Quick Access feature that gives customers faster access to Westpac One using a PIN, or via Touch ID, to check balances of selected accounts, transfer money between those accounts, and more, without having to log in.

[v] Deposits are equal to deposits at amortised cost as disclosed in the Westpac New Zealand Limited Disclosure Statement.

[vi] BT Funds Management (NZ) Limited is the scheme provider and Westpac New Zealand Limited is the distributor of the Westpac KiwiSaver Scheme. A copy of the product disclosure statement for the Westpac KiwiSaver Scheme is available from any Westpac branch in New Zealand or by visiting www.westpac.co.nz.

[vii] The Westpac KiwiSaver Scheme was rated Platinum by SuperRatings in 2015, 2016, 2017 and 2018. SuperRatings does not issue, sell, guarantee or underwrite this product. Go to www.superratings.com.au for details of its rating criteria.

[viii] https://www.superratings.com.au/wp-content/uploads/2017/10/KiwiSuper-Methodology-2017.pdf

[ix] Environmental reporting half-year period runs from July to December.