Westpac New Zealand (Westpac NZ)[i] says a strong half-year financial result has been driven by better than expected economic conditions.

Chief Executive David McLean said while the global COVID-19 pandemic was far from over, the financial effect on New Zealand had not been as significant as earlier feared.

“A year ago the outlook was very uncertain, with health, social and economic outcomes hanging in the balance.

“Thankfully, New Zealand has so far avoided the worst effects of the global pandemic, largely thanks to decisive leadership from the Government, and we are now cautiously optimistic.

“Westpac NZ’s balance sheet is sound and we’re well-positioned to support the economic recovery and the needs of households and businesses.”

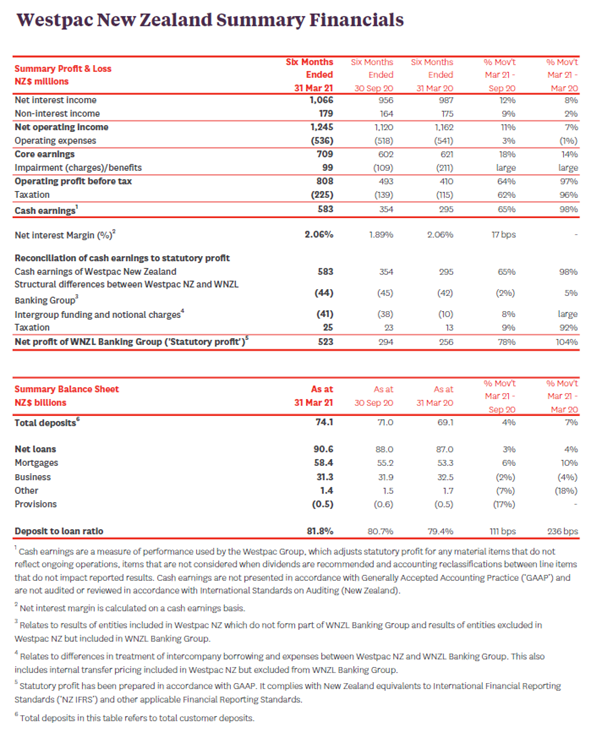

Westpac NZ’s financial results released today for the six months ended 31 March 2021 showed a 98% increase in cash earnings[ii], compared with the same period last year, driven by a significant change in expected loan impairments.

“In the past year we made impairment provisions that allowed for a severe financial impact of COVID-19. That was a prudent approach given the outlook at the time,” said Mr McLean.

“We still expect a softening of economic conditions during the remainder of 2021, but based on our current economic outlook, we are writing back $99m of the credit provisions which were taken last year, as they are no longer forecast to be needed.”

Supporting customers

Westpac NZ’s net interest margin remained stable at 2.06% compared to the prior comparable period, while lending increased 4%.

“We’ve offered low interest rates to customers and have taken a consistent approach to our LVR settings,” said Mr McLean.

“In January we released our lowest ever home loan rate of 2.29%pa. The special one-year fixed rate represented a drop of 20 basis points and other banks followed us.

“It’s pleasing that we’ve been able to help first home buyers to purchase 3,512 homes during the reporting period – a lift of 35% on the prior comparable period.”

Mr McLean said Westpac NZ was continuing to help customers coming off COVID-19 repayment assistance, and other households and customers that had experienced difficulties from COVID-19.

“We’re working closely with our business customers to check they’re faring okay through these uncertain times.

“Lending to large corporate and institutional organisations has eased off with some customers diversifying funding sources by issuing bonds, while others no longer need the same level of bank facilities that were made available in the early stages of the pandemic.

“We remain active in the agri sector, where we grew our market share.”

Mr McLean said the operation of the branch network had changed significantly in the past year.

“During lockdown, many of our customers discovered online banking, while others chose to use our contact centre or phone banking.

“It means our branch team are now picking up conversations with customers from across New Zealand on phone and email, as well as helping people face-to-face in their branch.”

Mr McLean said Westpac NZ had also embarked on a new partnership with former broadcaster Judy Bailey, aimed at supporting older customers to switch to digital banking.

“It’s great we have a Kiwi who is as trusted as Judy to help communicate the benefits of online banking, especially as we say farewell to cheques as a form of payment.

“We also have a strong relationship with SeniorNet, which does a fantastic job of building confidence among older internet users.”

Key Financials

(All comparisons are for the six-month period ended 31 March 2021 versus the same period last year)

- Cash earnings of $583m, up 98%

- Core earnings of $709m, up 14%

- Net operating income of $1,245m, up 7%

- Operating expenses of $536m, down 1%

- Impairment benefit of $99m, compared to an impairment charge of $211m in the prior comparative period

- Net interest margin 2.06%, no change

Home loans have grown by 10% year-on-year, while customer deposits[iii] have grown 7%.

Funds under management in the Westpac KiwiSaver Scheme[iv] increased by 27% year-on-year, to $8.7 billion as at 31 March 2021. The average Westpac KiwiSaver Scheme balance increased 28% over the same period to $22,373.

Westpac NZ had increased the number of employees by 3% to 4,501 FTE positions in the six months to 31 March 2021, with increases in risk, compliance and technology.

Business operations

Mr McLean said Westpac NZ was working closely with Westpac Banking Corporation on its review of its New Zealand businesses.

“It’s wise for all companies to regularly review the way business operations are structured and that’s what Westpac Group is doing.

“The key thing for our customers to know is that Westpac NZ remains very much open for business and that will be the case as we move forward, regardless of the ownership model.”

Mr McLean said Westpac NZ was prioritising independent reviews of its liquidity risk management and risk governance, as required by the Reserve Bank of New Zealand.

“A team has been established to work solely on these reviews. We’ve been focussing on these areas for some time and are now adding even more resources.”

Supporting New Zealand

Mr McLean said one of the highlights of the past six months had been the release of a climate risk report[v] – the first of its type from a New Zealand bank.

“The report detailed our exposure to climate-related financial risk, with a focus on sea level rise.

“We know that climate change will have significant economic and social impacts, and that’s why we support mandatory disclosure of climate risks by large businesses in New Zealand.

“This is an area we’ll keep focussing on and will be updating our customers as our analysis of climate risk becomes more detailed over time.”

On an annualised basis, operational carbon emissions for the six months ended 31 December 2020 were 38% lower than the year ended 30 June 2019[vi].

A significant initiative over the 2020/21 summer break saw Westpac NZ distribute more than 3,000 ‘Westpac Rescue Rashies®’ to young swimmers.

Mr McLean said each rash-vest could be zipped open at the front to reveal CPR instructions.

“Our friends at the Westpac Rescue Helicopter are kept busy through the summer saving the lives of people who have got in to trouble around the water.

“Westpac Rescue Rashies put CPR instructions where they’re needed most, enabling parents and guardians to help their child with confidence if the worst happens, while they wait for paramedics.”

About Westpac NZ

Westpac NZ has been serving New Zealanders since 1861 and is today one of the country’s largest full-service banks with more than 1.3 million customers.

We provide a full range of retail and commercial financial services including home and business lending, funds management, life insurance and treasury services.

Westpac NZ is committed to improving the social, environmental and economic wellbeing of all New Zealanders.

[ENDS]

[i] Westpac New Zealand is a division of Westpac Banking Corporation and is not the same as Westpac New Zealand Limited. The financial results of Westpac New Zealand Limited will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac New Zealand Summary Financials section of this media release.

[ii] Cash earnings are a measure of performance used by the Westpac Group, which adjusts statutory profit for any material items that do not reflect ongoing operations, items that are not considered when dividends are recommended and accounting reclassifications between line items that do not impact reported results. Cash earnings are not presented in accordance with Generally Accepted Accounting Practice (‘GAAP’) and are not audited or reviewed in accordance with International Standards on Auditing (New Zealand).

[iii] Deposits are equal to deposits at amortised cost as disclosed in the WNZL Disclosure Statement.

[iv] BT Funds Management (NZ) Limited is the scheme provider and WNZL is the distributor of the Westpac KiwiSaver Scheme. A copy of the product disclosure statement for the Westpac KiwiSaver Scheme is available from any Westpac branch in New Zealand or by visiting www.westpac.co.nz

[v] https://www.westpac.co.nz/about-us/media/westpac-nz-releases-first-climate-risk-report/

[vi] In-scope emissions for the six months ended 31 December 2020: 1,942 tCO2e. In-scope emissions for the year ended 30 June 2019: 6,225 tCO2e.