A majority of Kiwi households with mortgages are financially better positioned than a year ago to cope with the twin strains of Omicron and rising interest rates, according to Westpac NZ data.

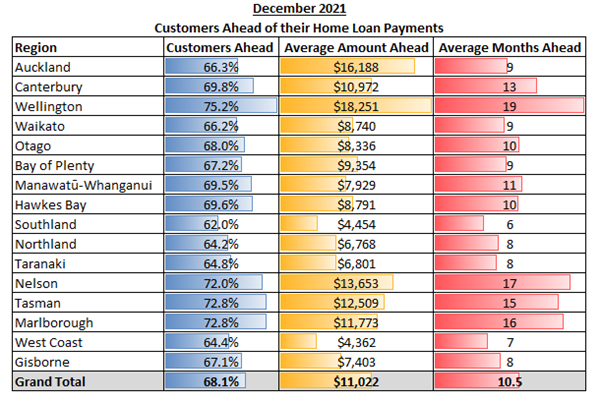

68.1% of Westpac’s home loan customers were ahead on mortgage repayments at the end of 2021, a jump from 65.9% at the end of 2020.

Those customers were ahead of their scheduled mortgage payments by a median amount of $11,022 or 10.5 months – up from $9,657 and 9.0 months at the same time in 2020.

The repayments helped push the collective mortgage “buffer” for Westpac NZ customers up by $637m.

Westpac NZ General Manager of Consumer Banking and Wealth Ian Hankins says he’s encouraged that customers are looking to pay off their mortgages faster.

“COVID-19 is going to be part of our lives for some time and at the same time interest rates have been rising, so building up a savings or mortgage repayment buffer is a good way to help manage disruptions to the economy or changes to your own personal circumstances,” Mr Hankins says.

“These figures are backed up by customer survey data showing 21% of homeowners have spent more on paying their mortgages off during the pandemic.

“We know interest rate rises and lending law changes have been a hot topic around the barbecue this summer, but these numbers give us confidence that our customers are in good shape for the year ahead.

“All our home loan customers have options, whether it’s locking in the certainty of a longer-term rate, taking the flexibility of a floating rate, or increasing their current repayments. They should think about what will work best for them, and come and talk to us for advice.

“We also know that lots of New Zealanders, especially in the tourism and hospitality sectors, will still be doing it tough, and the post-Christmas period can be a financially stressful time. We want to hear from these customers and work together with them to set them up for a better year this year.”

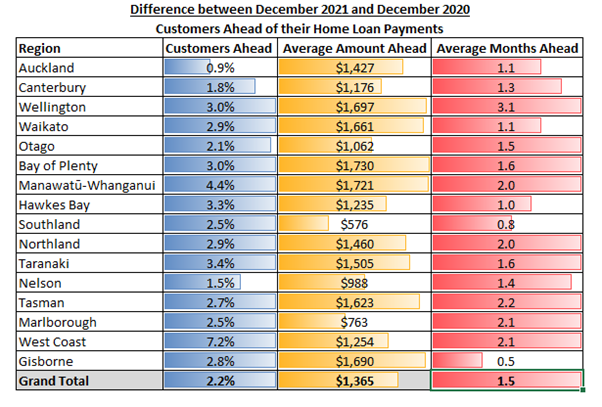

Every region improved its proportion of customers ahead of their repayments in the 12 month period, with West Coast (7.2%), Manawatu-Whanganui (4.4%) and Taranaki (3.4%) the star performers. Even in Auckland, which bore the brunt of long lockdowns in 2021, the average customer increased their buffer by nearly 1%.

The data shows the region in the best overall repayment position is Wellington, where more than three-quarters of homeowners (75.2%) are ahead on repayments, by an average amount of $18,251, or the equivalent of 19 months.

More than 70% of Nelson, Tasman and Marlborough customers are also ahead on repayments. Canterbury, Hawkes Bay, Manawatu-Whanganui and Otago are just shy of the 70% mark.

In Auckland, which has the largest average home loan size, customers are an average of $16,188 ahead on their repayments, which is the equivalent of nine months.

Customers needed to be at least three months ahead in their repayments to be included in this data.

“This means the true number of customers ahead of their repayments may be even higher, as there will be some who are one or two months ahead, who we haven’t included in this analysis,” Mr Hankins says.

ENDS

Editor’s note: Westpac NZ customer home loan repayments at a glance

- 1% of Westpac home loan customers were ahead on repayments at the end of December 2021, a more than 2% increase on the past 12 months;

- The average customer is $11,022, or roughly 10.5 months, ahead on repayments;

- Westpac customers’ collective mortgage “buffer” increased by $637m;

- Wellington is the leading region for both total proportion of customers ahead on repayments ($18,251) and average number of months ahead (19);

- West Coast (7.2%) and Manawatu-Whanganui (4.4%) recorded the biggest jumps in proportion of customers ahead;

- Every region saw an increase in customers ahead on repayments, including Auckland (0.9%).