Merchant service fees.

We offer pricing options to suit your business needs.

What are merchant service fees?

Westpac charges a merchant service fee (MSF) for certain types of card transactions processed through your merchant facility. The fee is charged as a percentage of each transaction.

What makes up a merchant service fee?

A MSF is made up of an interchange fee, scheme fee, switch fee and Westpac fee.

Interchange Fee updates.

In July 2025, the Commerce Commission announced new caps on Mastercard and Visa interchange fees.

Key dates and changes:

- From 1 December 2025, new fee caps apply to interchange fees for domestic personal credit card transactions. Fees for contactless debit card transactions will remain unchanged.

- From 1 May 2026, interchange fee caps will be introduced for credit and debit cards issued overseas, which are currently not regulated.

The updated interchange fee caps will be passed through to you, as your Merchant Service Fee includes the interchange fee. The impact will depend on your specific transaction mix, including the types of cards your customers use and the value of payments received. This change may result in either an increase or decrease in costs compared to current fee levels, and will vary from business to business.

To learn more about the changes and what they mean for your business, visit the Commerce Commission - Retail payment system.

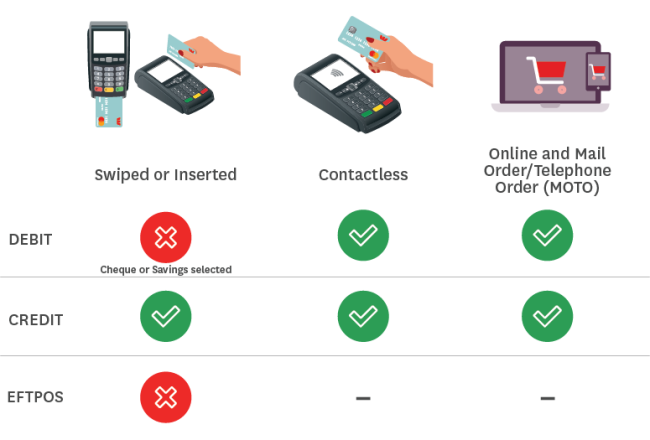

Compare payment types.

Which types of card transactions incur a merchant service fee?

Most types of card transactions incur a merchant service fee. However, you won’t pay a merchant service fee for New Zealand debit/EFTPOS card transactions made through your EFTPOS terminal if the cardholder selects ‘cheque’ or ‘savings’.

Pricing options.

We provide two pricing options – Blended and Interchange Plus. These options give you a choice of how to pay the interchange portion of your merchant service fee and offer different benefits to your business.

Blended pricing

Simplified pricing with a fixed fee per transaction type.

Example of a Blended pricing plan:

I have a small business. A simple pricing plan that’s easy to understand provides me more certainty in what my costs are, so I can plan and include these costs in my budget.

How it works

With Blended pricing, you pay a fixed merchant service fee that includes the interchange fee – giving you cost certainty from month to month. The fee is charged as a percentage of each sale, depending on the transaction type, as shown below.

|

MSF charged as a percentage of sale

|

Transaction type

|

|

0.00%

|

New Zealand debit/EFTPOS1 card inserted or swiped through an EFTPOS terminal.

|

|

0.69% |

New Zealand debit card tapped on an EFTPOS terminal (also known as a contactless payment).

|

|

1.29% |

New Zealand credit card inserted, swiped or tapped on an EFTPOS terminal. All international card payments2 made through an EFTPOS terminal.

|

|

1.89% |

New Zealand credit or debit card payment made online or over the phone – also known as mail order/telephone order (MOTO). All international card payments2 made online or via MOTO. |

|

Blended pricing is only available to customers that process less than NZ$500,000 in annual sales through their merchant facilities and have all facilities on Blended pricing. Charities (MCC: 8398) are not eligible for Blended pricing. |

|

1 The debit/EFTPOS card must be swiped or inserted into an EFTPOS terminal, then ‘cheque’ or ‘savings’ account selected. If the cardholder selects credit, this may cause the transaction to be processed as a credit transaction instead.

2 If international card payments make up more than 15% of the total number of transactions you process in a consecutive three-month period, we may need to review your pricing option. You can find out more about when we can make rate changes in your Merchant Services Agreement.

Interchange Plus pricing

Interchange Plus offers greater transparency in fees – we directly pass on the interchange fee incurred for each transaction you process.

Example of an Interchange Plus pricing plan:

I have a mature business operating in 20 locations throughout the country. I like the transparency and insight I get through an Interchange Plus fee, such as the card types and my customers' preferred method of payment.

How it works

With Interchange Plus, your merchant service fee for each transaction is made up of two costs – the variable interchange fee set by the card schemes, plus a fixed Westpac fee that’s calculated as a percentage of sale and covers the other acquiring costs. This means any change to the interchange fees by Visa, Mastercard or UnionPay are passed on to you.

How is the interchange fee calculated?

Your interchange fee for each transaction will vary depending on a variety of factors, including:

- Card type (credit/debit/prepaid)

- Method of payment (instore/online)

- Whether the card is locally or internationally issued.

Where can I find Mastercard and Visa interchange fees?

Domestic interchange fees are updated periodically and published on the Visa and Mastercard websites. This shows the maximum interchange fees that can be applied to Mastercard and Visa transactions in New Zealand.

What are the interchange fees for Westpac issued cards?

Each bank sets their own interchange fees for the cards they provide (issue) to cardholders based on the maximum fees published by Mastercard or Visa.

The table below shows the interchange fees you’ll pay for Westpac issued Mastercard transactions. For example, if your business is on Interchange Plus pricing and accepts a contactless Mastercard consumer credit card transaction, you will pay 0.50% of the sale plus your fixed Westpac fee for that particular transaction.

Westpac domestic card issuing interchange fees.

The following fees are current as of 1 December 2025 and are subject to change by Westpac without notice. All fees shown are expressed as a percentage of the transaction amount.

Mastercard credit card transactions

|

Programme type |

Rate |

|

Charities |

0.00% |

|

Tokenised contactless (excluding commercial cards) |

0.30% |

|

Contactless (excluding commercial cards) |

0.30% |

|

Strategic Merchants 1 – Card Not Present |

0.50% |

|

Strategic Merchants 2 – Card Not Present |

0.60% |

|

Tokenised Online (excluding commercial cards) |

0.70% |

|

Commercial Card Present - Education, Fuel, Government, Utilities |

0.60% |

|

Commercial Card Not Present - Education, Fuel, Government, Utilities |

0.70% |

|

Consumer - Card Present |

0.30% |

|

Consumer - Card Not Present |

0.70% |

|

Commercial - Card Present |

2.10% |

|

Commercial - Card Not Present |

2.10% |

Mastercard debit card transactions

|

Programme type |

Rate |

|

Charities |

0.00% |

|

Tokenised Contactless |

0.20% |

|

Contactless |

0.20% |

|

Strategic Merchants 1 – Card Not Present |

0.30% |

|

Strategic Merchants 2 – Card Not Present |

0.35% |

|

Contact - Card Present |

0.00% |

|

Tokenised Online |

0.60% |

|

Card Not Present |

0.60% |

Mastercard prepaid card transactions

|

Programme type |

Rate |

|

Charities |

0.00% |

|

Strategic Merchants 1 – Card Not Present |

0.50% |

|

Strategic Merchants 2 – Card Not Present |

0.60% |

|

Commercial |

2.10% |

|

Tokenised Online |

1.20% |

|

Consumer - Card Present |

0.60% |

|

Consumer - Card Not Present |

1.25% |

Things you need to know.

The information on this page is a guide only. Participation in a Westpac Merchant Services Agreement is subject to Westpac's approval. Westpac's current credit criteria apply. Terms, fees and charges apply to Westpac products and services.

Mastercard is a registered trademark and the circles design is a trademark of Mastercard International Incorporated.