Natural capital.

New Zealand’s natural environment is central to our economy, culture and wellbeing.

From freshwater and soil to native forests and wetlands, nature supports all sectors, especially agriculture and tourism in Aotearoa. Westpac NZ recognises that the decline in the health of Aotearoa’s natural assets and biodiversity is a growing risk to our business, customers and communities.1

With more than 70% of Aotearoa’s export earnings relying on nature2, nature loss poses financial risks. Investing in nature-positive solutions opens new opportunities. By financing projects that restore ecosystems and reduce environmental harm, we can help build a stronger, more resilient economy and support our customers in future-proofing their businesses.

Our commitment.

Westpac Group’s Natural Capital Position Statement outlines our commitment and approach to becoming a nature-positive bank. In Aotearoa, Westpac NZ’s internal Natural Capital Action Plan sets out the key actions we’re taking to make that ambition a reality. Read more on our progress in our Sustainability Update and ESG Dashboard.

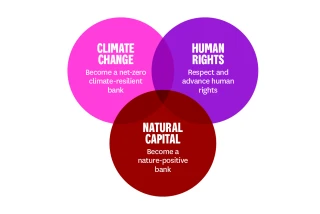

Interconnection with climate and human rights.

Nature, climate and human rights are deeply connected. Healthy ecosystems play a vital role in regulating the climate, storing carbon, protecting against extreme weather and supporting resilience.

At the same time, nature loss can directly impact people’s fundamental human rights to health, food, water and cultural identity, particularly for tāngata whenua. That’s why our approach considers these issues together, making sure our actions support both environmental and social outcomes.

Read more about our approach to climate change and human rights.

Helping our customers.

Understanding our nature risks.

As a first step in assessing our nature-related risks, we used the ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure) framework as a screening tool to identify the nature-related impacts and dependencies associated with the sectors we finance.

We then mapped our lending portfolio against these sectors to create the weighted scores below.* This table highlights where our financing is linked to moderate (M), high (H), or very high (VH) levels of nature dependency or impact. While some sectors are inherently more impacting or dependent on nature, their overall scores may be lower due to the relative size of our lending exposure. The ENCORE assessment shows that our agricultural sector lending has the greatest dependencies and impacts on nature, scoring Very High on both impacts and dependencies.

ENCORE is a recognised risk assessment tool by the Taskforce for Nature-related Financial Disclosures (TNFD) framework. However, it is important to note that ENCORE is a high-level tool. It doesn't provide location-specific or company-level insights, nor does it forecast future environmental changes. Instead, it serves as a starting point to help us identify areas for deeper analysis and action.

|

ANZSIC sector |

Dependencies |

Impacts |

|

Accommodation, cafes & restaurants |

VH |

H |

|

Agriculture |

VH |

VH |

|

Construction |

H |

H |

|

Finance & insurance |

L |

M |

|

Forestry & Fishing |

H |

H |

|

Government administration and defence |

M |

M |

|

Manufacturing |

H |

H |

|

Mining |

H |

VH |

|

Property |

H |

M |

|

Property & business services |

H |

M |

|

Services |

H |

M |

|

Trade |

M |

M |

|

Transport & storage |

M |

M |

|

Utilities |

H |

H |

*Lending exposure used for this assessment is as at 30 September 2025.

Separately, we continue to disclose our lending exposure to sectors considered by the TNFD to have material nature-related dependencies and impacts. This measure uses a different categorisation of sectors focused specifically on those TNFD considers to have material nature-related impacts or dependencies rather than the ANZSIC sectors used in the ENCORE assessment.

We use ANZSIC sectors for ENCORE because they are mapped to our lending portfolio and align with our Disclosure Statement. This disclosure provides further transparency and insight into our nature-related risk profile and aligns with one of the two core metrics recommended by the TNFD for financial institutions.

Read more in the Nature section of our ESG Dashboard. We will continue to build our understanding of our impacts and dependencies on nature and share our progress.