Sustainable investment.

How we invest sustainably: our positive outcomes – and what we exclude.

How we invest sustainably.

We are BT Funds Management (NZ) Limited, the investment arm of Westpac in New Zealand.

As one of New Zealand’s largest asset managers, we acknowledge the huge responsibility we have to drive positive outcomes and prosperity for our people, communities, and the environment. We believe investing sustainably is a powerful way to achieve results both on and off the balance sheet.

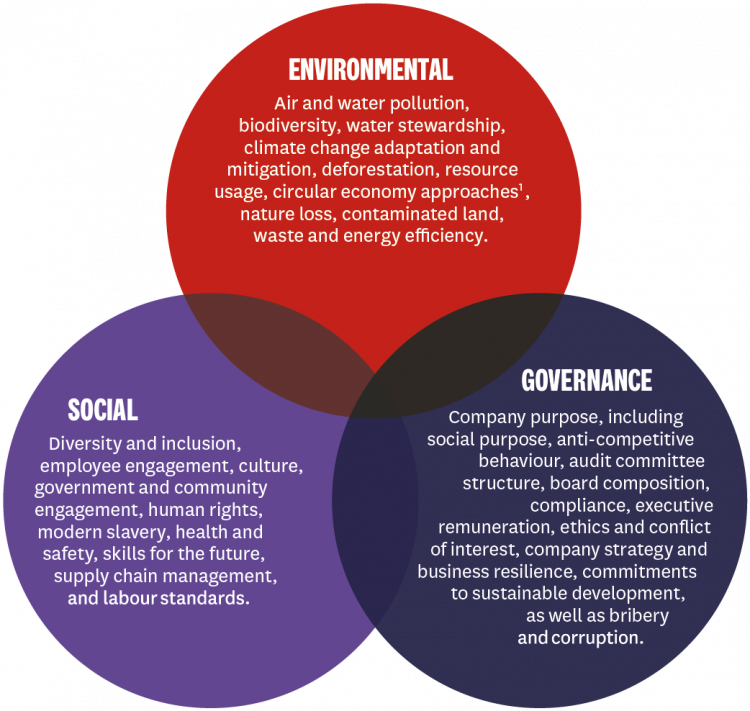

We think about the impacts, risks, and opportunities of every potential investment from an environmental (E), social (S) and governance (G) perspective – together known as ESG.

For all investment decisions our four guiding sustainable pillars include positive outcomes, integration, stewardship, and exclusions.

See how we’re progressing against our sustainable investment commitments in the 2022 BTNZ Sustainable Investment Report.

Our commitment to sustainable investing

We're proud that our Westpac KiwiSaver Scheme funds, Westpac Active Series and Westpac Premium Investment funds, open for investment, have been certified, except for the Cash Funds, by the Responsible Investment Association Australasia (RIAA)1. They have been certified by RIAA according to the strict operational and disclosure practices required under the Responsible Investment Certification Program.

See responsiblereturns.com.nz for more details.

Positive outcomes.

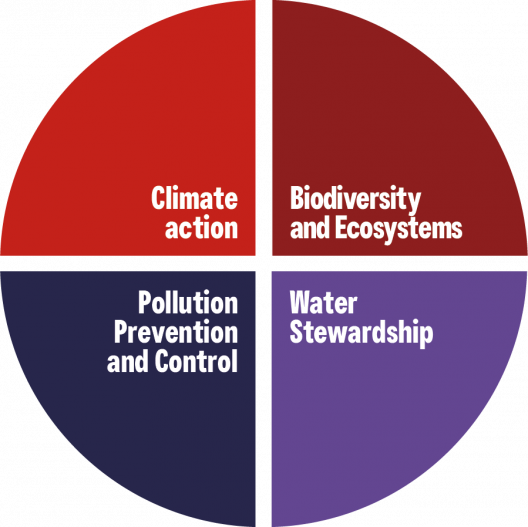

We believe climate change, ecosystem destruction, and biodiversity loss are some of the most significant issues to impact our environment – and our economy.

We are working to align our investments with the environmental objectives outlined in the European Sustainable Investment regulation1. This regulation is recognised, in the absence of a global sustainable standard, as the most comprehensive and respected approach.

We are committed to:

Climate action

- Aligning our assets under management to a 1.5°C pathway and net-zero greenhouse gas (GHG) emissions by 2050 or sooner.

- Managing our climate risks and opportunities in line with the TCFD recommendations.

- Investing more in companies that adopt or provide climate solutions e.g. energy efficiency, electric vehicles

Biodiversity and ecosystems

- Investing more in companies that adopt or provide nature and biodiversity conservation, sustainable land use, and forestry management

Water stewardship

- Investing more in companies that adopt or provide water management, water efficiency and security of supply

Pollution prevention and control

- Investing more in companies that contribute to improved levels of air, water and soil quality or reduce their negative impact

We encourage the use of circular frameworks to reduce resource consumption.

For more information refer to our full Sustainable Investment Policy.

Integration.

We, and our investment managers investing on our behalf, incorporate environmental, social and governance (ESG) factors into our investment analysis – both before we decide to invest in a company and then again during regular reviews. And we believe that sustainable businesses are more likely to thrive in the long term and achieve better outcomes for everyone.

We assess and monitor our investment managers on their commitment to sustainability.

Example of key ESG factors that can be considered:

1 A circular (as opposed to linear) economy is one in which resources are built to be returned into new products and by-products are used to generate other products.

Stewardship.

To us, stewardship is the responsible management of our customer’s long-term investments as well as using our influence to maximise overall long-term value.

We believe that stewardship helps promote higher standards of corporate governance, which contributes to sustainable value creation, addresses climate change, and increases the long-term return to our customers.

Stewardship, is undertaken by both BTNZ and our underling investment managers. It includes engaging with companies we are invested in to ensure they align with our sustainable expectations and targeted positive outcomes and also voting at their shareholder meetings accordingly. Voting is generally undertaken by our investment managers, who exercise our voting rights on our behalf. See how we have voted in our two voting records for 2022.

Another aspect of stewardship is collaboration with industry members to drive and influence systemic change.

Our exclusions.

We don’t invest in companies that operate outside of our sustainable investing criteria1:

Companies breaching International Conventions

We exclude any company in breach of International Conventions to which New Zealand is a party1. We will also not invest in any NZ company not permitted under New Zealand law.

Companies not meeting minimum social safeguards

We exclude any company breaching human, labour and environmental principles in line with the UN Global Compact1.

Controversial & other weapons

We do not invest in any company that derives any revenue from controversial weapons manufacture. We don’t invest in nuclear, biological, and chemical weapons, phosphorous mining, depleted uranium, anti-personnel mines and cluster munitions) or companies that both manufacture and sell assault weapons to civilians.

Fossil fuels

We exclude any company where the primary activity is oil and gas drilling, exploration and production, equipment and services or integrated oil and gas2, or which derives more than 10% of its revenue from oil and gas exploration, production or refining (including Artic exploration, oil sands extraction and shale energy exploration or production).

Coal mining & production

We exclude any company where the primary activity is coal and consumable fuels2, or which derives more than 10% of its revenue from the extraction of thermal coal.

Coal electricity generation

We exclude any company that derives more than 50% of its revenue from generating electricity from coal.

Whale meat

We do not invest in any company that derives any revenue from the processing of whale meat.

Tobacco

We do not invest in any company that derives any revenue from manufacturing tobacco products.

Predatory lending

We exclude any company that derives any revenue from predatory lending1.

Other companies

We exclude any company that we understand is not performing on ESG factors and expected to negatively impact our investments or has not responded positively to active engagement. From time to time, we may exclude other companies not aligned with our sustainable values or beliefs.

About our exclusions: we rely on advice from our ESG research provider(s) for exclusion criteria, standards and assessments. Where we use derivative based instruments or (in the rare instance) third-party fund or exchange traded funds, we aim to align our exclusions as closely as possible, and for third-party or exchange traded funds at a minimum we apply our fossil fuel and weapons exclusions as required by our default KiwiSaver status.

Implementation of this exclusion criteria can be affected by the accessibility and accuracy of data, or an error by an external service provider. This may result in inadvertent holdings in investments we are seeking to exclude. In this event, as soon as this has been identified, the investment manager is required to divest within ten business days.

For details on how we manage our exclusions please refer to our full Sustainable Investment Policy.

1 As defined by our third-party ESG research provider(s)

2 As defined by the Global Industry Classification system

We are proud members of or a signatory to:

- UN Principles for Responsible Investment

- Responsible Investment Association of Australasia

- Investor Group on Climate Change

- Net Zero Asset Managers

- Climate Action 100+

- Toitū Taha Centre for Sustainable Finance Centre

- Taskforce on Climate-related Financial Disclosure

- Aotearoa New Zealand Investor Coalition for Net Zero.

Things you should know.

All our managed funds, including the Westpac KiwiSaver Scheme, Westpac Active Series, Westpac Retirement Plan and Westpac Premium Investment Funds are managed under our Sustainable Investment Policy.

1The Responsible Investment Certification Program does not constitute financial product advice. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Appropriate professional advice should be sought prior to making an investment decision. RIAA does not hold a Financial Advice Provider licence.

BT Funds Management (NZ) Limited (BTNZ) is the scheme provider and issuer, and Westpac New Zealand Limited is a distributor of, the managed investment schemes referred to above, including the Westpac KiwiSaver Scheme. You can get a copy of any applicable Product Disclosure Statement for these investments from any Westpac branch in New Zealand.

The information above is subject to changes to government policy and law, and changes to the applicable managed investment scheme, from time to time. Investments do not represent bank deposits or other liabilities of Westpac Banking Corporation ABN 33 007 457 141, Westpac New Zealand Limited or other members of the Westpac Group of companies.

They are subject to investment and other risks, including possible delays in payment of withdrawal amounts in some circumstances, and loss of investment value, including principal invested. None of BTNZ (as manager), any member of the Westpac group of companies, The New Zealand Guardian Trust Company Limited (as supervisor), or any director or nominee of any of those entities, or any other person guarantees any scheme's performance, returns or repayment of capital.