Alerts.

Set up alerts on any Westpac account to help you stay on top of what's happening with your money.

Benefits.

- Get notifications when your account balance goes above or below a certain amount.

- Help avoid fees - get notified when payments don't clear or when a credit card bill is due.

- Get alerts when there's activity on your account, such as a login to your Westpac One® online banking.

Choose your alerts.

Set up & manage alerts.

It's easy to set up alerts in Westpac One by following these steps.

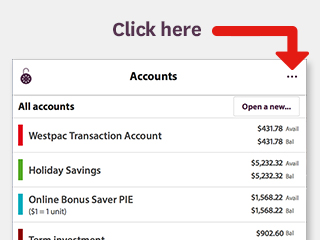

1. Login to Westpac One and click here:

(Skip this step on desktop)

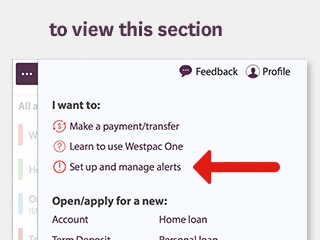

2. Tap 'set up and manage alerts' here:

Don't have Westpac One?

Call us on 0800 400 600 and press 6 or visit us in branch and we'll get you set up.

Smart money tools.

Things you should know.

Account terms and conditions apply.

There are some countries that block TXT messages from New Zealand, so if you have not received a TXT message from us within 5 minutes, you will need to phone the Westpac Contact Centre directly on +64 9 912 8000 (international toll charges apply). We’re available weekdays from 7.00am to 8.00pm and weekends from 8.00am to 5.00pm NZT.