Buying your first home.

Our local home loan experts are here to help guide you through the home buying journey, so you can get into your first home sooner.

Get cash back on your first home loan.

Apply for a new Westpac home loan of $250,000 or more for your first home and you could get $3,000 or more cash back, to help make your home greater.

How it works

- All applicants must be first home buyers as determined by Westpac.

- Available on new Westpac residential home loans of $250,000 or more.

- This limited offer may be withdrawn at any time without notice.

Talk to our experts to see whether a Westpac home loan is right for you.

Low deposit options to help you get into your first home sooner.

You don’t always need a 20% deposit to buy your first home. Explore our range of low deposit options to get closer to a home you can call your own.

Calculators.

See all calculatorsHow much can I afford?

Get an idea of how much you could borrow using our affordability calculator.

How much will my repayments be?

Work out how much your home loan repayments might be.

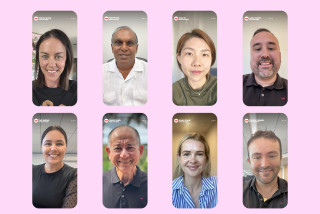

Speak to a Home Loan Expert.

Have a free, no obligation chat with one of your local home loan experts to learn more about our range of low deposit options, designed to help you into your first home sooner.

Meet face-to-face

Our Home Loan Experts can come to you at a time and place that suits you.

Apply online

Existing customers can apply for a home loan via Westpac One® online banking.

First Home Buyer Seminars.

Come along to a seminar run by our Home Loan Experts covering:

- your local housing market,

- tips on pulling your deposit together,

- and what we're looking for in your home loan application.

Contact your local Home Loan Expert to find events in your area.

The process.

Apply

Conditional approval

Note, if there's a second applicant they will also need to agree to the application and a credit check.

Start house hunting!

Featured rates.

* Min 20% equity, plus salary credit to a Westpac transaction account. Not available with any other Westpac home loan offers, promotions or package discounts. Loans for business or investment purposes excluded.

If you don’t pay amounts when they’re due, your loan account may exceed its limit and the rate of interest that’ll be applied to the overlimit amount will be the interest rate + 5% p.a.

Things you should know.

1 The information above is subject to changes in government policy and law, and changes to the Westpac KiwiSaver Scheme, from time to time.

2 Conditional approval requires a credit check, confirmation of the details provided in your application and responsible lending inquiries. Other conditions may also apply depending on the nature of your application.

Westpac's eligibility criteria, home loan lending criteria, terms and conditions apply. A low equity margin may apply.